WASHINGTON—Whether it is loans for mortgage, education, cars, or credit cards, deceptive lenders have wreaked havoc on personal finances and the economy overall. The large number of housing foreclosures has revealed that many Americans, particularly Hispanics and blacks, are victims of predatory lending.

The federal government is ratcheting up its efforts to prohibit loan discrimination and deception. One initiative is centered at the U.S. Department of Justice, which has created the Fair Lending Unit in its Civil Rights Division. The Unit seeks to eliminate lending discrimination.

A second initiative resulted from Congress’s establishment of the Consumer Financial Protection Bureau (CFPB) in response to the financial crisis. Within the CFPB, the Office of Fair Lending and Equal Opportunity was recently formed to overcome unfair and discriminatory practices related to finances of individuals and communities.

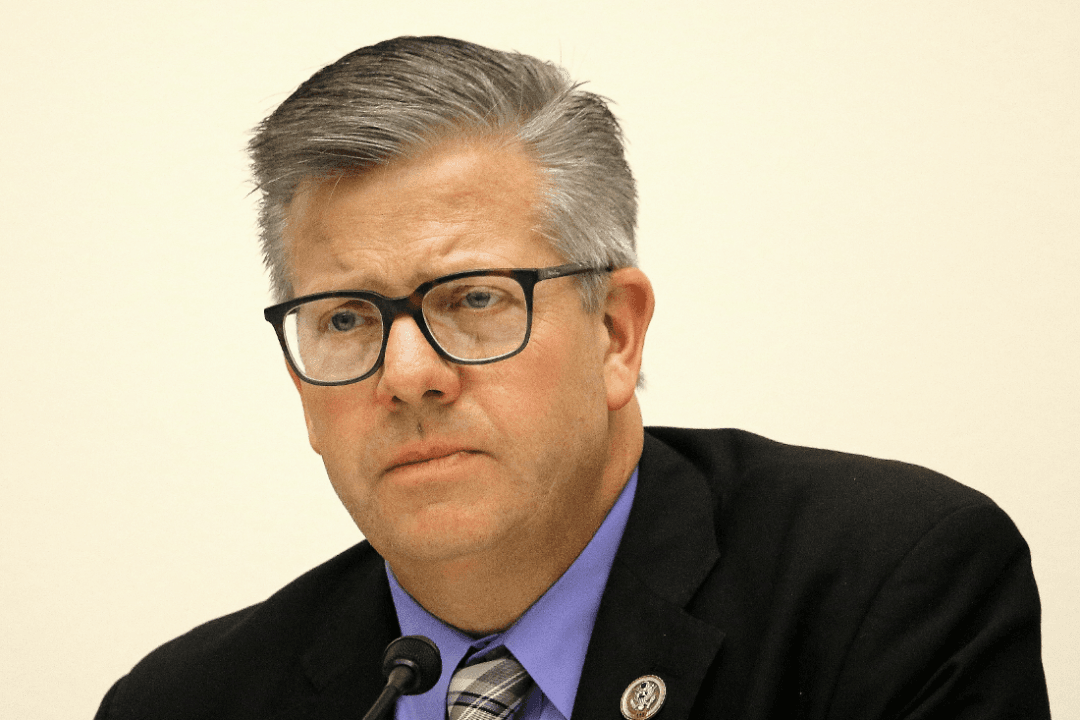

“I think the federal government needs to be a credible deterrent in the fair lending context,” said Tom Perez, Assistant Attorney General for Civil Rights, U.S. Department of Justice. Perez spoke on May 4 at the Center for American Progress (CAP) on what is being done to foster fair, non-discriminatory lending.

Perez explained that soon after President Obama appointed him in 2009, the Justice Department added the Fair Lending Unit to the Civil Rights Division. The unit filed a record number of fair lending cases in 2011. In his two years at DOJ, Perez said the Department has taken on 17 lending cases, compared to 37 cases in the prior 15 years.

Perez is especially proud of DOJ’s landmark $335 million settlement with Countrywide Financial Corporation. The Justice Department announced on Dec. 21, 2011 the largest residential fair lending settlement in history. Countrywide Financial Corporation was alleged to have discriminated by charging more than 200,000 Hispanic and African-American borrowers higher fees and interest rates than non-Hispanic white borrowers with equal creditworthiness.

Countrywide was also alleged to have steered more than 10,000 minority borrowers into subprime mortgages when non-Hispanic white borrowers with similar credit profiles received prime loans. Perez said that qualified minorities were 2.1 to 3.5 times more likely to be steered into a subprime loan.

“The Countrywide case is a perfect example of the discrimination that we have attempted to combat,” Perez said.

Perez also mentioned that financial compensation for victims in the several cases Justice has handled is not the only solution needed. He said that “credit repair” needs to be addressed as well. He used as examples the harm done to the credit reputations of military service members and veterans that had wrongly been foreclosed.

Many Complaints of Unfair Lending

As a representative from the DOJ, Perez welcomed the new bureau that will be tackling all aspects for ensuring fair access to credit and nondiscriminatory lending. The special Office of Fair Lending & Equal Opportunity (“Office,” for short) inside the Bureau was created last July and is still getting off the ground.

Patrice Ficklin, Assistant Director of the Office, joined this CAP discussion on fair lending. The new bureau seeks to ensure that “markets for consumer financial products and services are fair, transparent, and competitive,” according to Ms. Ficklin at the Office website.

According to Ficklin, the Office already receives 14,000 complaints a month, and stressed that it has “yet to roll out its full functioning.”

The Office will take the lead in providing oversight and enforcement of federal fair lending laws, including the Equal Credit Opportunity Act (ECOA), which prohibits discrimination in any credit transaction, including mortgage loans, car loans, student loans, and credit cards. The CFPB also has authority over the Home Mortgage Disclosure Act, which requires lenders to disclose mortgage data.

The basis for discrimination includes race, color, religion, national origin, gender, marital status, and age, among others. A creditor may not use any of these reasons to refuse someone credit if the borrower qualifies for it. It also means the creditor cannot try to discourage the borrower, or provide credit terms different from those with similar creditworthiness.

Ficklin sees the Office functioning as an educator for consumers and creditors. The bureau has a plain language task force that endeavors to get lenders to write at a seventh grade level. The Office is currently partnering with a couple of credit card issuers towards developing prototype language that consumers can easily understand. The Office’s website is pitched at the seventh grade level, which may explain why it looks different from your typical federal bureaucracy website.

Ficklin said the Office was given jurisdiction over the nonbanks, that is, finance companies that provide capital but do not take in deposits. She said this is the first time that there will be oversight of nonbanks. The iterative rule-making for nonbanks is being developed now.

Students can benefit from the Office’s most recent addition on education lending, which teaches them to compare college costs and offers they receive. Student loans can be difficult to understand, as evidenced by the many senior citizens still working to pay them off.

The Epoch Times publishes in 35 countries and in 19 languages. Subscribe to our e-newsletter.