WASHINGTON—The stock market ended the turbulent year of 2020 at all-time highs, despite the pandemic lockdown measures and resulting economic recession. With 2021 underway, the political events of the first week will set the tone for the new year, as they have important implications for the political landscape and the markets going forward.

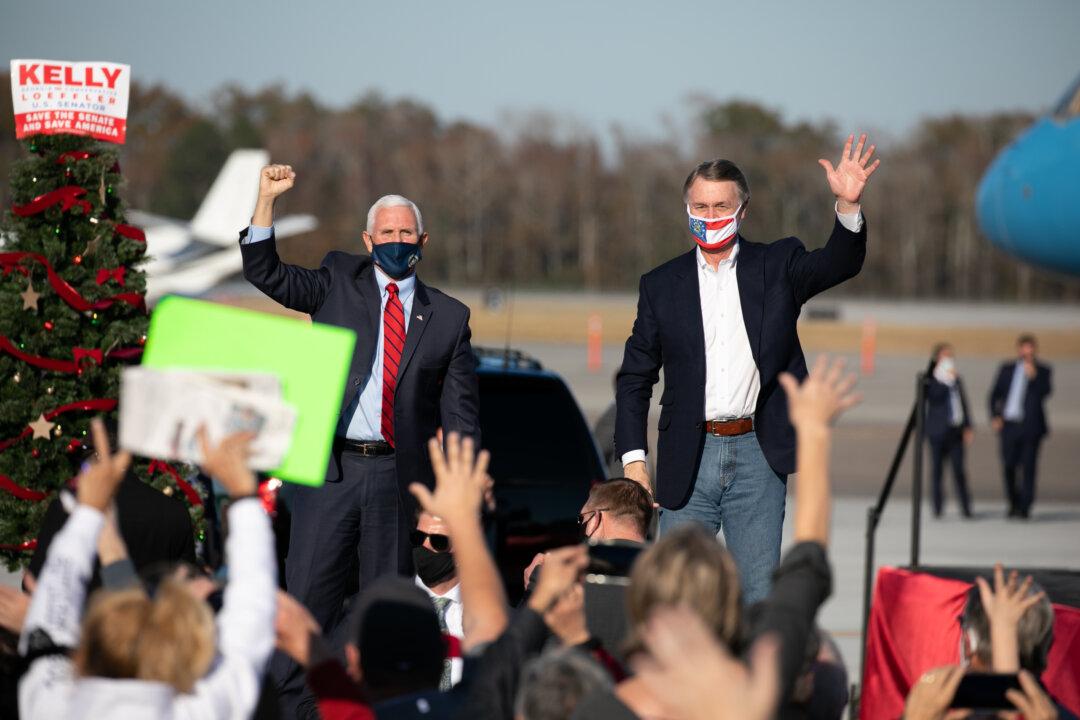

The focus will be on the Georgia runoff elections on Jan. 5, which will determine control of the Senate and policies in Washington. Also, investors will closely watch the joint session of Congress on Jan. 6, which is expected to be “a very contentious meeting.”