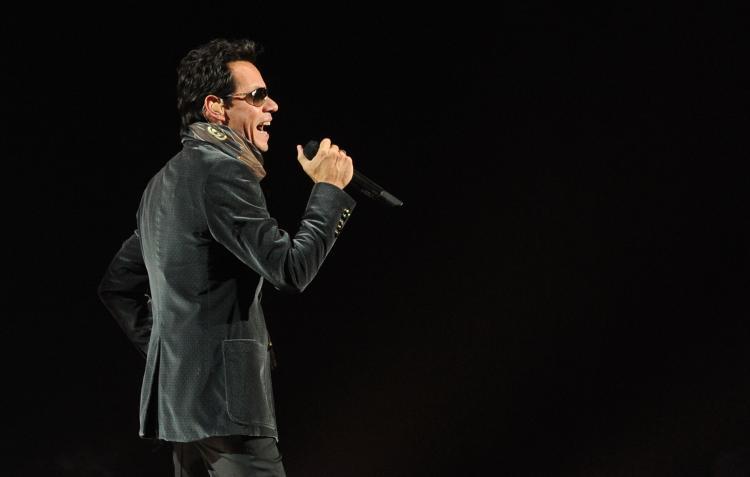

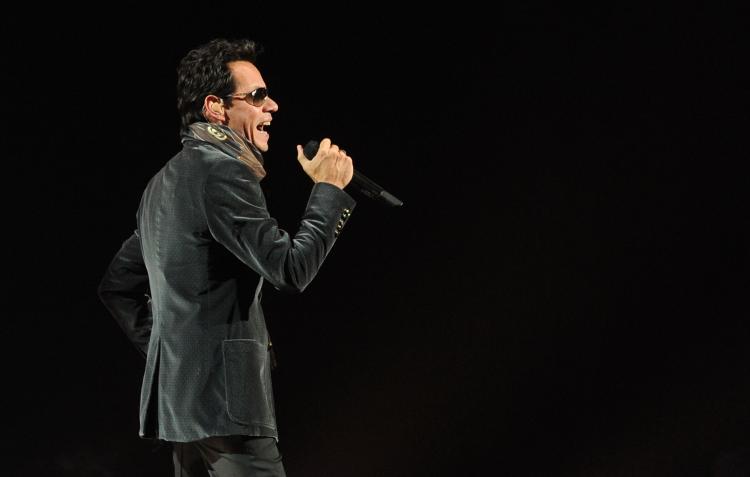

New York State authorities filed a demand for $1.8 million in back taxes against singer Marc Anthony, singer-actress Jennifer Lopez’s husband, Radar Online reported on Thursday, Dec. 30.

The $1.8 million came on March 29, 2010 for his unpaid taxes on his Long Island estate, just three months after a federal tax lien for $1.6 million was placed on the same property. It remains unclear whether Anthony has settled the debt.

In 2007, he had to pay $2.5 million in back taxes, upon ignoring the tax collector for four years. Anthony blamed the unpaid taxes on his business management company and paid the fine, according to Radar.

Anthony, 41, is a multi-millionaire, and married Lopez, also 41, in 2004. Their twins, Max and Emma, were born in February 2008.

Lopez earns about $20 million annually, while Anthony takes in $11 million. The couple are also investors in the Miami Dolphins, according to The Huffington Post.

The $1.8 million came on March 29, 2010 for his unpaid taxes on his Long Island estate, just three months after a federal tax lien for $1.6 million was placed on the same property. It remains unclear whether Anthony has settled the debt.

In 2007, he had to pay $2.5 million in back taxes, upon ignoring the tax collector for four years. Anthony blamed the unpaid taxes on his business management company and paid the fine, according to Radar.

Anthony, 41, is a multi-millionaire, and married Lopez, also 41, in 2004. Their twins, Max and Emma, were born in February 2008.

Lopez earns about $20 million annually, while Anthony takes in $11 million. The couple are also investors in the Miami Dolphins, according to The Huffington Post.