WASHINGTON—The growth of low-wage work that pays $14 per hour or less, is a troubling sign for the future. A July national survey of low-wage workers, found that most low-wage workers are barely getting by.

A pair of low-wage workers described their experiences. Nyah Potts is a single mother with a 1-year old, and a server at a restaurant in the Ronald Reagan building. Her employer is a federal subcontractor. She is paid $3.50 per hour plus whatever tips she makes on a given day. She sees no way to make enough to go back to school. By the time she pays for child care and transportation, she has little net pay. She said it is inhumane to value someone so little as to pay her $3.50 per hour.

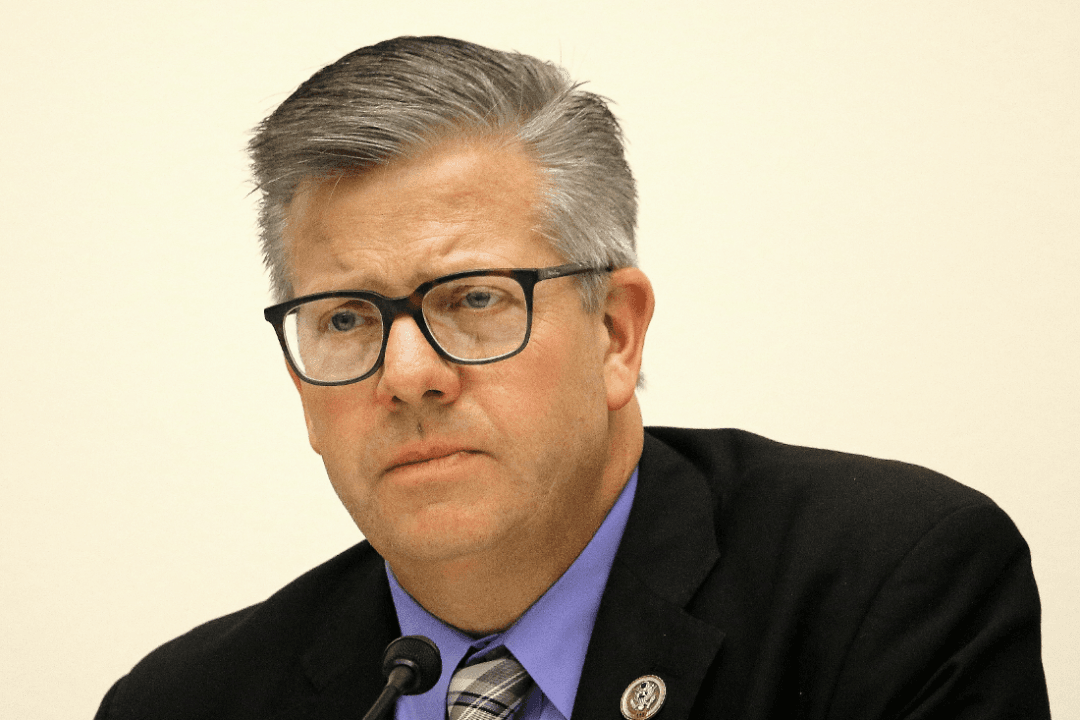

Rep. Keith Ellison (D-Minn.) criticized the tax, trade, and education policies as not working in “the interest of the American people.” Ellison said, “It should be an economy that works for everybody.”

There are 2 million low-wage workers who work for federal subcontractors, more than for Wal-Mart and MacDonald’s combined, said Ellison.

Tiffany Beroid, married and mother of two, works for Wal-Mart for $10.70 per hour as a customer service manager with “huge responsibilities,” she said. Last year she was given such limited hours that she grossed $12,000. She said store managers treat her disrespectfully and never greet her.

Empathy, Persistence

Former Rep. James Walsh empathized with the working poor. He said it was his experience that very few of the poor are “slackers.” “People are working as hard as they can and can’t get ahead.” In this situation Walsh said, the government needs to step in and provide work training and other assistance.

“People don’t believe there is equal opportunity anymore and that the system is rigged,” he said.

He said that programs to help the poor, such as Medicaid, Social Security Disability, food stamps, community health centers, and public assistance are bipartisan programs. His Republican colleagues want to do the right thing. They want to see the government programs run more efficiently, he stressed.

Walsh said that programs and policy changes must be bipartisan to succeed. He said it takes persistence to get legislation passed. It’s okay to question policies, but “try not to question people’s motives,” he said.

Barely Making It

The survey found that nearly 6 out of 10 low-wage workers (59 percent) said that they “just meet” or “don’t have enough to meet” their basic living expenses. PEW asked the general population the same question and found 35 percent were just scraping by.

“Being a low-wage worker today means never being able to escape worrying about your financial future,” said Guy Molyneux, from Hart Research Associates, which conducted the survey on behalf of Oxfam America.

Molyneux spoke about the survey at the Economic Policy Institute (EPI), in a program called Working Poor in America: The Harsh Reality Facing Our Nation’s Low-Wage Workers, on Nov. 15.

The survey found that 83 percent of low-wage earners worry about not having enough money for retirement, 82 percent worry about health expenses they can’t pay, and 65 percent worry about not being able to afford healthy food for their families.

Average Age 35

The survey report cited an EPI analysis in 2012, which found that 33 million low-wage workers earn less than $10 per hour. Only 12 percent of those are teenagers.

The average person making $10 per hour is 35 years old, and many are parents.

The survey found that 30 percent of low-wage workers work more than 40 hours per week, and one in six works two or more jobs.

Low-wage workers have high aspirations. They want to advance themselves, obtain a college degree (57 percent), have their children graduate from college (81 percent), and have their children be better off financially than themselves (89 percent).

The survey found “widespread pessimism about economic mobility in America.” Molyneux said that there is a 6 to 1 ratio of a person falling out of the middle class as a poor person rising to the middle class.

The belief that one can work hard and get ahead is hard to sustain when one can’t make ends meet and opportunities for advancement are nil.

No Robust Recovery

This low-wage worker survey can be put in a larger context of a sluggish U.S. economy, said economist Heidi Shierholz at EPI. Low-wage workers are discouraged because opportunities are few.

Despite appearances, she said the economy hasn’t come close to a full job recovery from the recession. During 2008 and 2009, the economy lost 8.7 million jobs. With the recovery, we are still down 1.5 million jobs from the number when the Great Recession began in December 2007. However, to keep up with the growth of the population, the economy needed an additional 6.5 million jobs. Consequently, Shierholz said the economy is short 8 million jobs.

National unemployment reached 10 percent in 2010 and now is 7.3 percent. Note that 7.3 percent is still higher than the worst it ever was at 6.3 percent during the pre-recession years in 2003.

Further, the unemployment number appears better than it really is. It masks all the discouraged workers who have given up seeking work. Shierholz, using the EPI analysis of Mitra Toossi, said unemployment would be 10.8 percent if the missing workers were included.

The high unemployment puts downward pressure on wage growth. “Employers do not have to pay big wage increases to get and keep the workers they need when workers don’t have outside options,” Shierholz said.