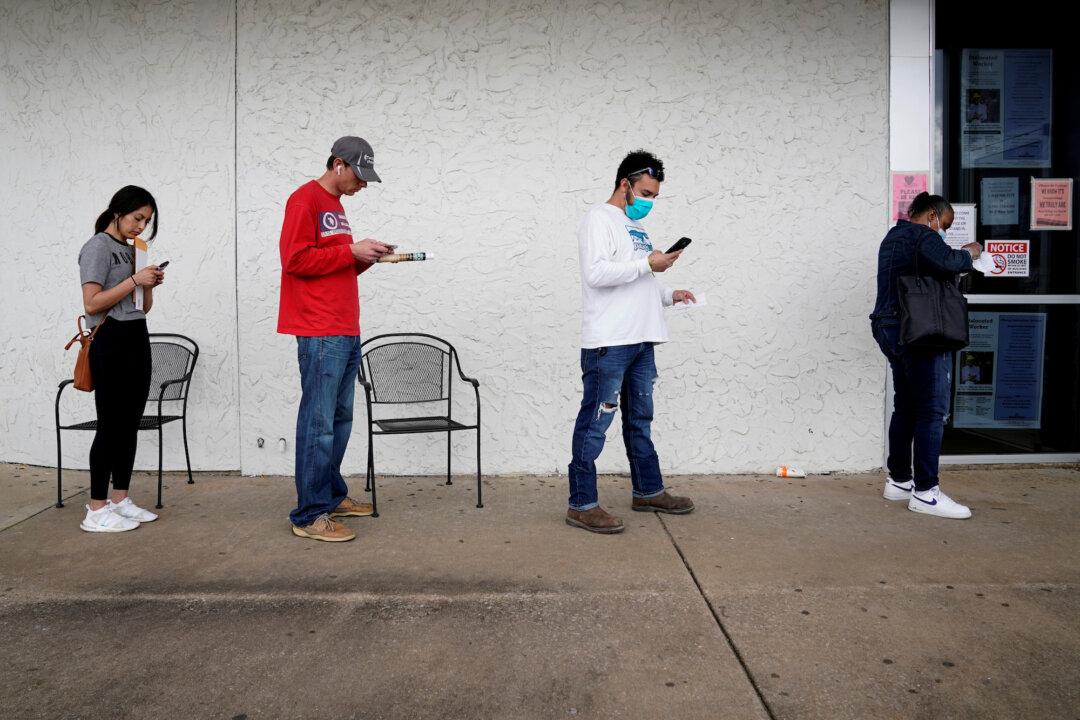

As the pandemic continues to wreak havoc on the economy, more than 3 million workers in the United States filed unemployment claims during the week ending May 2, bringing the number to more than 33 million in the past seven weeks, which is around 22 percent of the workforce.

The number of people filing initial jobless claims for the week ending May 2 was 3,169,000, while the previous week’s level was revised up by 7,000 to 3,846,000, the Labor Department said in a release (pdf).