For foreign investors, a series of strikes in the last two months in mainland China has not been the only factor contributing to China’s manufacturing market losing its appeal.

Low wages and the renminbi (RMB) exchange rate were the main incentives for many foreign investors to originally invest in mainland China, but now those premises are being challenged. Many large corporations are considering withdrawing from China or relocating to other developing countries. Some will even move their production lines back to the West.

According to a report by Japanese newspaper, Yomiuri Shimbun, rising wages, labor shortages and a series of unprecedented worker strikes in mainland China have had a long-term impact on Japanese companies’ strategies, forcing them to reconsider their long-term goal of using China as their low cost export base. Moreover, the anticipated rise of the RMB exchange rate will further erode the profitability factor for exporters.

Japan Turns to Thailand

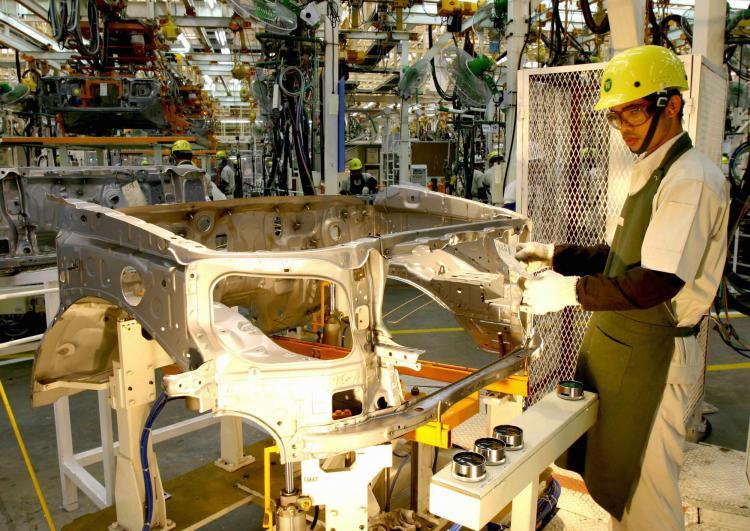

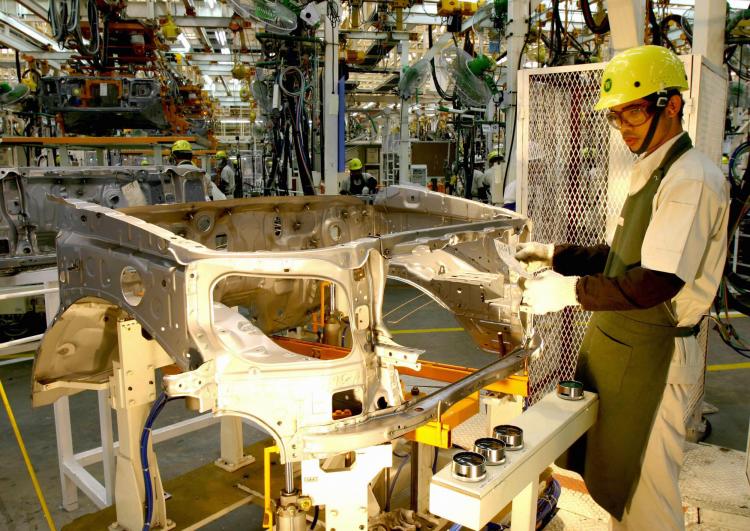

The annual salary for a Chinese Honda worker currently can run as high as US$4,500 to 5,500: about twice that of Indian workers, and 33 percent higher than Thai workers.

Kyodo News reported that the Thai government has defined small cars that have fuel consumption and carbon dioxide emission levels lower than standard compliance guidelines as “green cars,” and encourages their production through tax reduction and exemption incentives.

Japan’s auto makers are now strengthening their production operations in Thailand. Various companies now consider Thailand to be a production and export base for environmentally-friendly and energy-efficient “global strategic models.” They plan to open new plants or increase production lines in Thailand.

Mitsubishi Motors President Osamu Masuko announced on July 5 that the company will set up its third factory in Thailand. Mitsubishi plans to invest 15 billion baht (US$464 million,) and will begin production of a new model known as the “global small car” in 2012. Prior to this, Mitsubishi had committed to investing eight billion baht (US$247 million) in producing fuel-efficient cars. Masuko also said that many Japanese parts manufacturers have already stationed themselves in Thailand in order tp cut costs.

Toyota has three assembly plants in Thailand, with an annual output of about 550,000 cars. The company is now considering expanding its factories to prepare for the production of new small car models in 2013. Tanada Kyoichi, President of Toyota Thailand Company said that the company hopes to strengthen production in Thailand, making it their export base for the Middle East and Asian regions, including Japan.

Nissan spent 5 billion baht (US$155 million) to develop its new model, codenamed “March,” which went into production in March at a plant near Bangkok. Within three and a half months, it has acquired 16,000 orders, accounting for 80 percent of the domestic sales target in Thailand for this year.

Though some people are worried about political risks, such as demonstrations by the “Red Shirt Army,” Nissan President Ghosn made it clear that no dent had been made in the company’s production target due to the political unrest: moreover, its sales had actually increased.

In fact, Honda and Suzuki also plan to invest billions of yen in producing environmentally friendly vehicles next year, joining the ranks of those auto companies that are making Thailand their production base of choice for “clean, energy-efficient and low-cost” small cars.

China’s Restrictions

The “Investing Across Borders 2010” report recently released by the World Bank Group, listed China as one of the countries with the most restrictions on foreign ownership of companies. In its defense, China deemed the report to be inconclusive, stating that foreign direct investment (FDI) in China had been soaring every year.

The EU Chamber of Commerce in China said in its annual business confidence survey on June 29 that regulatory interference and unpredictability are the greatest concerns of European businesses operating in China. While most of the more than 500 companies that participated in the survey were optimistic about China’s growth outlook, they expressed concern about the communist leadership’s regulatory environment discriminating against foreign companies.

They reserved the option to leave, if necessitated by deteriorating conditions. Of those queried, 36 percent felt that government policies had become less fair over the past two years, while about 40 percent expect regulatory conditions to worsen in the next two years.

The Alix Partners survey issued in February indicates that China’s overall cost advantage is shrinking. Labor costs have been rising by 15 percent a year since the implementation of the new labor contract law in 2008. Tax preferences for foreign companies ended in 2007 and the cost of land, water, energy and shipping are on the rise, making it more expensive to manufacture goods in China compared to countries such as Mexico, India, Vietnam, Russia and Romania.

Read the original Chinese article