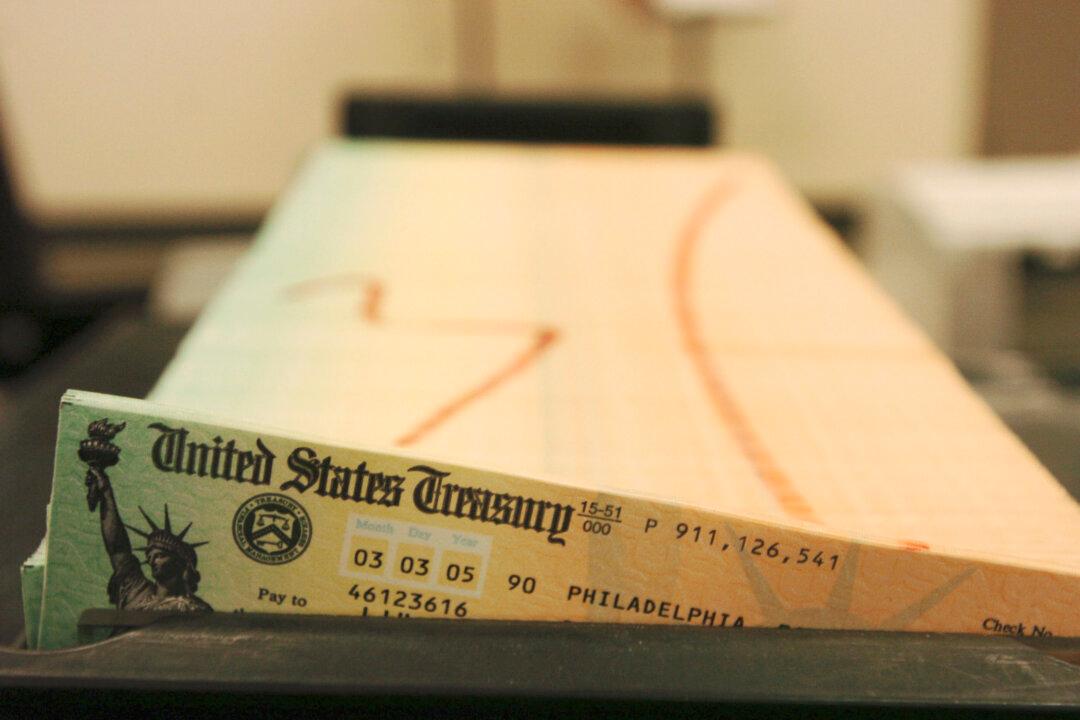

Financial markets could be signaling that demand for U.S. government bonds is starting to weaken following abysmal results at a recent Treasury auction.

The United States sold $20 billion of 30-year bonds at an Oct. 12 Treasury auction. Primary dealers—financial institutions required to participate in these auctions and purchase supply not acquired by other bidders—scooped up more than 18 percent of the bonds, higher than this year’s average of nearly 11 percent.