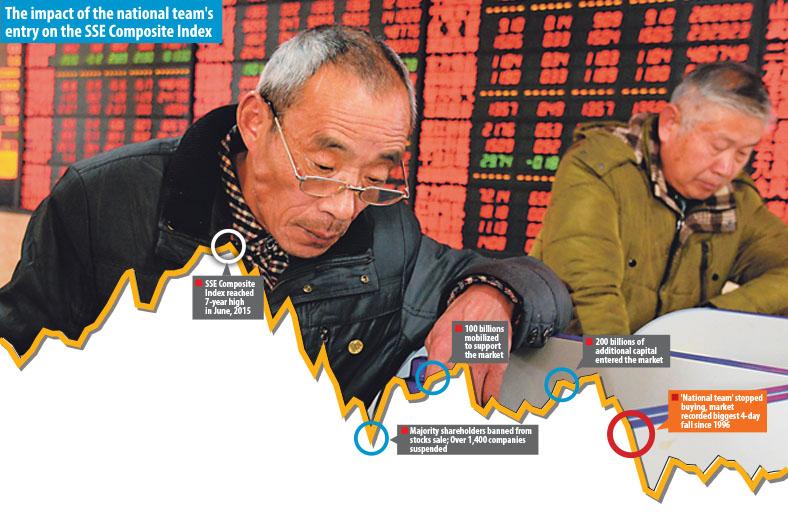

China’s “national team,” which was organized by the authorities and endowed with billions in cash to save the stock market following last year’s crash, pledged that the rescue operation would extend into the next few years. However, reports published by a number of listed companies have revealed that it has been staging a silent retreat.

This has led to an uproar from battered investors, who demanded greater disclosure of information by the China Securities Regulatory Commission (CSRC). Investor confidence has also fallen to a new low.

Turbulence in China’s A-share market has continued in 2016 following the crash. The Shanghai index has suffered a cumulative fall of some 18 percent since the beginning of the year.

On Aug 14 last year, the CSRC issued a public announcement that stated, “In the coming few years, the China Securities Finance Corporation (CSFC) will not retreat from the market, and its role to stabilize the market will remain unchanged.”

It also declared that the CSFC would enter into an agreement with Central Huijin Investment Ltd. so that the latter could become a long-term investor in the stocks concerned.

However, Xu Caiyuan, a 38-year-old professional investor who became famous in Wenzhou for protecting investor rights, said that the national team is quietly retreating from the market. He said their selling activities might have exacerbated the recent fall in the market and provided him with new evidence for suing the CSRC.

The CSRC and the CSFC, a key member of the national team, have remained tight-lipped on the rescue operations thus far.

Shareholdings decrease

Reports published by A-share listed companies for the last quarter of 2015 revealed that as of March 3, the national team is no longer on the top 10 stockholders lists of no less than 30 listed companies. According to some reports, these included four non-bank financial companies, including Shaanxi International Trust Co. Ltd. and Chengdu Honqi Chain Co. Ltd.

Shareholdings have also decreased in Anxin Trust Co. Ltd. (by 14.5 million shares), Everbright Securities (53 million shares), and China Merchant Securities (6.75 million shares).

Xu expects that more companies will meet with the same fate. He pointed out that in this market crash, he suffered the biggest blow in his 18 years of investment experience.

Many of his friends also lost big fortunes, some amounting to hundreds of millions of yuan, he said. Those who had engaged in margin trading are now heavily in debt.