Employment levels in Irish business will be back at pre-crisis levels by 2016 says Irish Business and Employers Confederation (IBEC). Those were the findings published in a jointly produced report by IBEC and PricewaterhouseCoopers (PwC) last week.

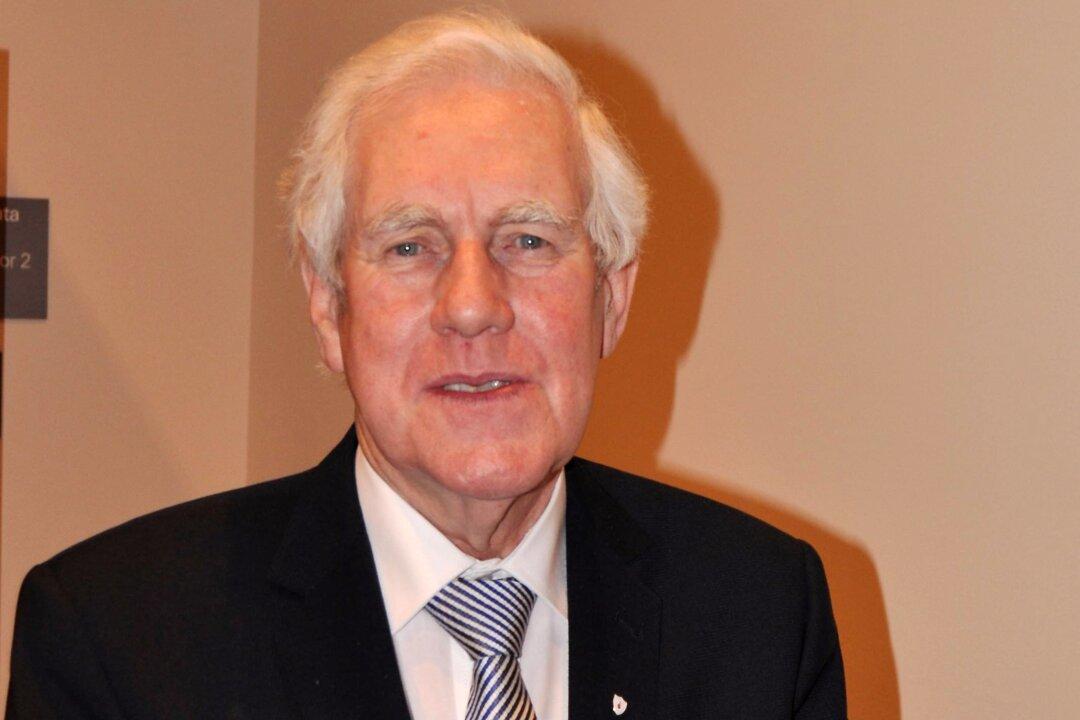

Launching the report ‘Going for Growth’ at the CEO Conference, IBEC Director General Danny McCoy said: “Despite the ongoing global economic uncertainty, Irish firms are planning for a bright future.”

According to Mr McCoy, due to high export levels, companies in Ireland continue to have ‘ambitious’ employment and investment plans for 2012 and as far as 2016. “Exporters are investing heavily again in their business as they have limited spare capacity due to their strong sales performance of the past two years,” explained Mr McCoy.

“Many firms operating in the domestic market continue to have spare capacity,” said McCoy who added that this is a positive signal. The reasoning being that these businesses still have the equipment and skills to grow over the coming years when conditions are right.

“Many of these companies are now looking overseas to grow and expand. By 2016, the domestic sector will have regained all of the output lost during the downturn.”

PwC senior partner Ronan Murphy said: “Based on the survey and our experience with clients, Irish businesses have undertaken significant adjustments to their business models mainly in the areas of cost reduction and process re-engineering in order to ensure the sustainability of their operations for the future.”

The result of these adjustment, according to Mr Murphy, is a leaner, meaner more competitive Irish market place. “This is particularly important as we strive to hold and grow our international investment. With our competitive tax regime and highly skilled workforce, the fundamentals of Ireland’s economy have remained intact,” said Mr Murphy.

“The survey also indicates that investment capacity exists and this, together with the necessary finance being available, will ensure that Ireland’s position as a competitive ‘gateway’ for international business will be strengthened.”

SME Credit Issue Continues

Access to credit for businesses is still a day-to-day issue that many companies face. In a bid to address this, the government has commissioned a survey, ‘SME Lending Demand Study’ prepared on behalf of the Department of Finance.

With respect to the survey, Minister for Jobs, Enterprise and Innovation, Richard Bruton said “Access to credit is a major issue for many of the small businesses on whom we depend to create the jobs and economic growth which we so badly need, and is an area in which government will intervene to create a better environment for job-creation in Ireland.”

“One key finding of the report is that micro-enterprises have suffered particularly from the downturn, and are subject to more credit refusals than other businesses. Micro-enterprises will have a key role to play in creating the employment that will get us out of this crisis, which is why last week the government announced details of a 100 million euro Micro Finance Loan Fund, which will impact 5,000 businesses and will be in place in the first quarter of 2012,” said Minister Bruton.

Recently, the government announced details of a Temporary Partial Credit Guarantee Scheme, to ensure that more credit can flow to viable SMEs.

ISME, the Irish Small & Medium Enterprises Association, has expressed concern at the findings of the ‘SME Lending Demand Study’.

According to ISME Chief Executive, Mark Fielding, “The findings of the report confirm that only 50 per cent of companies who applied for credit have had their application fully approved, outlining that the balance was refused or pending a decision. This figure deteriorates for micro-enterprises, with 42 per cent of companies fully approved. This is a long way from the nine out of ten ’successful' applications as outlined by some banks.”

“Despite the cheerleading from government, access to credit is deteriorating, the application process is getting longer and businesses are not being told their rights. If the banks continue to refuse to lend to viable businesses, the government must introduce the alternative options including the promised State Investment Bank with a bias towards SME lending',” concluded Fielding.