NEWS ANALYSIS

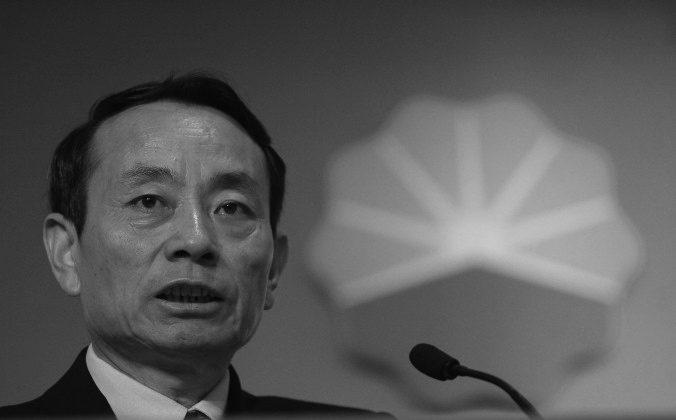

If you don’t do well heading one of China’s state-run enterprises, you won’t just get fired. You will also be prosecuted for corruption charges, whether the charges have any basis in fact or not. This is what happened to the former chairman of China’s largest oil company, PetroChina Co. Ltd., Jiang Jiemin.

State-run media reported Sept. 1 that Jiang Jiemin—not to be confused with former top communist party leader Jiang Zemin—would be investigated for “suspected serious disciplinary violations.”

Jiang was the chairman of PetroChina from May 2007 to March 2013, and also headed PetroChina’s parent company, the China National Petroleum Corporation (CNPC). Until his investigation, he briefly headed an organization overseeing all of China’s state-owned companies.

Four other PetroChina executives and one from Kunlun Energy Ltd. are also under investigation.

Oftentimes, in China, corruption charges are trumped up to remove political opponents. In Jiang’s case, however, the allegations might be true.

One thing is for certain: his management of PetroChina and CNPC was not successful. The stock price of PetroChina hit an all-time high of 19.66 Hong Kong dollars in November 2007, shortly after he became chairman. Since then it went down, concurrent with a general decline in the Chinese market, to 8.6 Hong Kong dollars, a loss of 56 percent. CNPC owns PetroChina, but is not itself a public company.

On Aug. 23, PetroChina reported a 6 percent gain in earnings per share (EPS) for the first half of 2013 compared to the same period a year earlier. But Citigroup analysts think these numbers mask the true picture of earnings. Adjusting for certain nonrecurring gains, EPS was down 29 percent over the year—this number more realistically reflects the often-bad investments of previous years that fall under Jiang’s tenure. Citigroup now has a “sell” rating on the stock.

“[As] the market increasingly focuses on deteriorating earnings in other parts of the business, we are concerned that PetroChina’s valuation could de-rate,” says the report.

Chinese scholar Cai Shenkun thinks there is a reason why PetroChina and CNPC spent so much on capital expenditure and that it provides the link to the corruption charges. According to Cai, the executives around Jiang Jiemin used company funds to buy equipment from relatives.

“The main beneficiaries of the case are the in-laws of a high level official,” he writes in his blog. “Only for one oil field project, CNPC paid the beneficiaries $800 million. … They use overseas organizations to accumulate billions of dollars for their family.”

He goes on to explain that, in a state-owned company like PetroChina tightly controlled by the Communist Party, high-level executives can tell their subordinates how to spend the money for corporate expansion projects. “They have the absolute power to distribute resources,” he writes, adding that loopholes in control and financial management make it easy to hide the corruption.

In an analysis, he also explores another route of corruption: importing cheap oil from abroad and selling it at above-market prices in China.

“They import low-priced fuel through diplomatic channels and rob the state of large amounts of money through complicated investments at home and overseas,” he writes.

Ironically, even if the corruption allegations are true, they might also serve to get rid of a political opponent of President Xi Jingping. Jiang Jiemin was a close ally of Zhou Yongkang, former head of security and friend of disgraced party official Bo Xilai. This is a welcome opportunity for Xi Jinping to move control of state resources into his own hands.