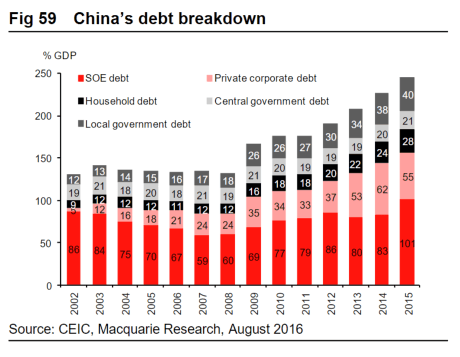

For years the world has marveled at China’s foreign exchange reserves ($4 trillion at their peak in 2014) and low government debt, 21 percent of GDP at the end of 2015.

This is about to change, however, as fiscal spending was up 15.1 percent in the first half of 2016 to counter a slowing economy and achieve the official GDP growth target.

“China’s growth rebound in the first half of this year has been strongly supported by an active fiscal policy that has significantly front-loaded on-budget spending and fostered strong growth in off-budget investment in infrastructure,” Goldman Sachs wrote in a note to clients.

China's debt distribution. Macquarie