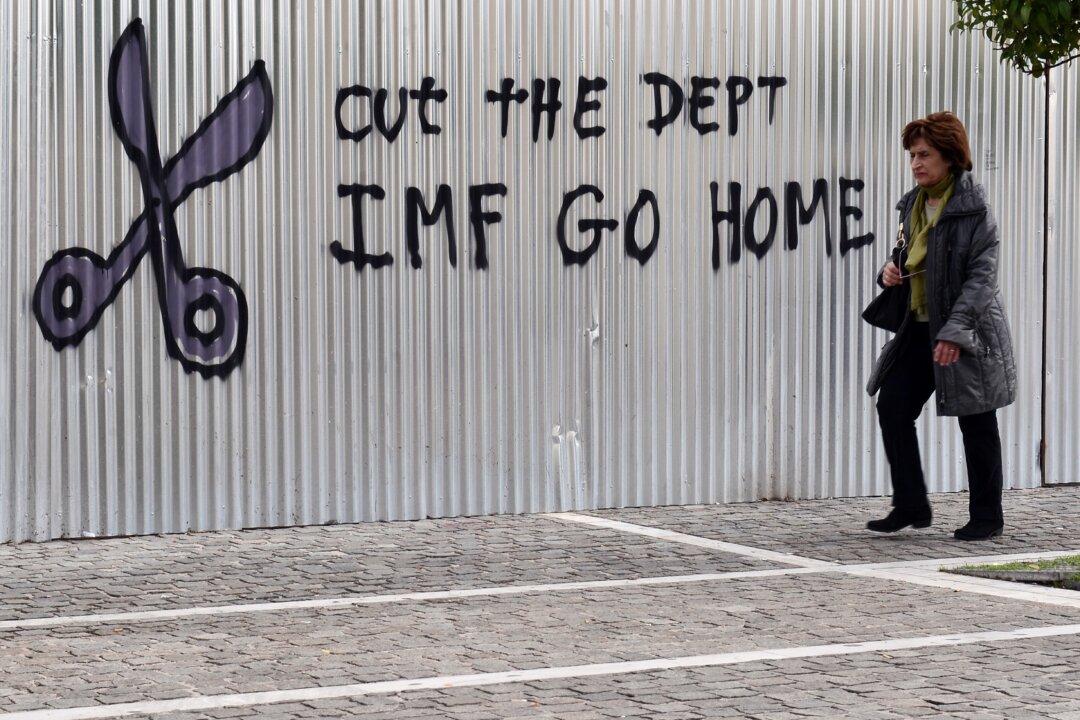

Since Greece’s new government under Alexis Tsirpas came into power in January, it has been trying to strongarm the nation’s creditors (mostly the European Union and the International Monetary Fund) into relaxing their austerity requirements. More recently, Greek citizens have gotten into the act, seeking to protect themselves while gaming the EU financial system.

Greece owes 316 billion euros (US$345.14 billion) of national debt and 240 billion euros to the European Union. This Friday, it has to repay 305 million euros to the International Monetary Fund (IMF). So of course Greece’s Finance Minister Yanis Varoufakis knows that a default will hurt the European official sector and has used this as a bargaining chip in negotiations.

Now Hans-Werner Sinn, a professor at Munich University and president of the Ifo Institute of Economic Research, said Greek private citizens have also borrowed money from other EU central banks (far beyond the official sector debt).

They are using these sums as leverage in case something goes wrong, and Greece is allowing them to do so to strengthen its bargaining position.