French carmaker PSA Peugeot Citroën announced a 819 million euro ($994 million) loss for the first half of 2012 yesterday in Paris. This compares to a gain of 806 million euros ($978 million) in the first half of 2011. Revenues also decreased to 29.6 billion euros ($35.9 billion), down 5.1 percent year-on-year, with automotive revenues sliding 10.5 percent.

Shares were down 2.5 percent on the Paris stock exchange. PSA, which doesn’t sell any cars in the United States, sold a total of 1.6 million cars during the first half of this year, as European nations sank further into recession.

Cash Burn Makes Layoffs Necessary

Europe is being hit the hardest, as the company expects a revenue decline of 8 percent in 2012 in this, its core market. Countries like Italy and Spain that are especially affected by the sovereign debt crisis, but also France could see a reduction in revenues of as much as 10 percent.

This means the company is burning through cash at an unsustainable rate. Free cash flow for the first half of 2012 was a negative 954 million euros (negative $1.16 billion), excluding the exceptional positive cash dividend by the group’s financing arm of 449 million euros ($545 million).

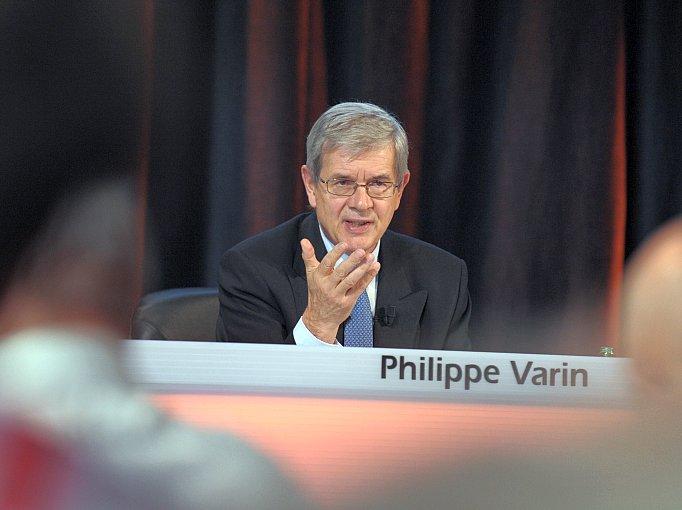

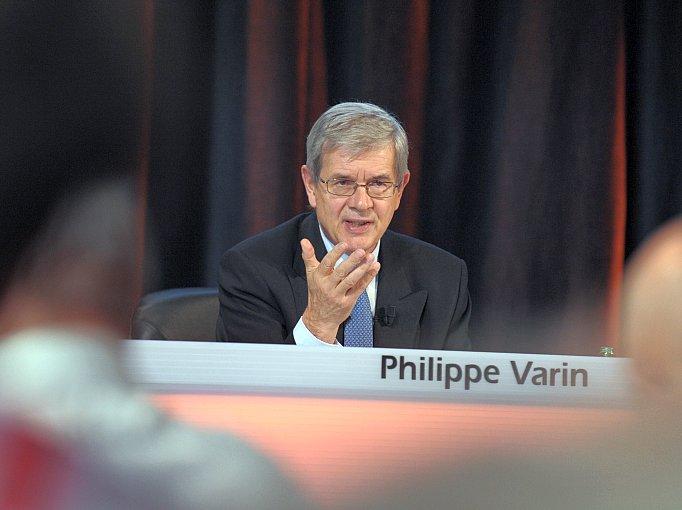

The cash burn implies that the company’s cost base is too high and revenues are too small to cover it, which Chairman Philippe Varin acknowledged at a press conference following the announcement of results: “The group is facing difficult times. The depth and persistence of the crisis impacting our business in Europe requires the launch of the reorganization of our French production base and a reduction in our structural costs.”

In practice, this will mean significant layoffs, and the group already announced the closure of its plant in Aulnay near Paris with 3,000 employees in 2014 and plans to fire another 11,000 employees elsewhere across the company.

Through cost cutting, a reduction in investment outlays, and through unlocking synergies in an alliance with General Motors, the company plans to generate 1.5 billion in cash by 2015.

Ratings Downgrade as French Government Intervenes

These drastic cost-cutting measures are necessary, as analysts say that the company only has cash reserves for two years if the burn continues, and rating agencies have downgraded the company to junk status. The credit market is not behind the curve, as prices on Credit-Default-Swaps—a type of insurance contract—on the group’s senior debt recently hit a record high and imply a default probability within five years of more than 50 percent.

Analysts at Citigroup see increased cost of funding as a further obstacle on the road to a turnaround: “PSA FS … would still, in our view, be mostly reliant on unsecured funding, which would probably become more expensive and a competitive disadvantage if there were a credit downgrade.”

Given the dire situation, the French government saw it necessary to intervene. According to a Bloomberg report, French President François Hollande announced that he would try to influence Peugeot and rework its plan of announced layoffs. The government will conduct its own review and release it at the end of July. This could be bad news for Peugeot as it might reduce its flexibility in cutting costs.

For their part, Peugeot PSA employees and union members protested the announced layoffs and plant closing at demonstrations in front of the group’s headquarters in Paris Wednesday.

The Epoch Times publishes in 35 countries and in 19 languages. Subscribe to our e-newsletter.