The United States has taken a major hit as Fitch Ratings has lowered its Long-Term Foreign-Currency Issuer Default Rating for the country from AAA to AA+.

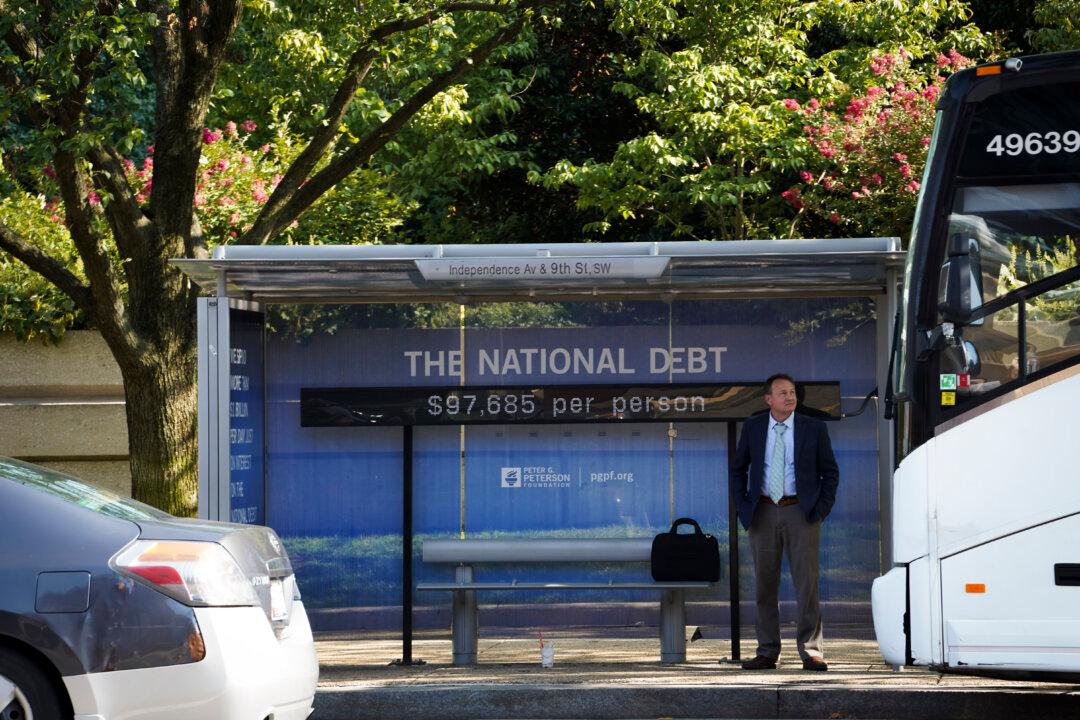

The U.S. credit rating has been lowered because of “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance” over the past two decades, according to the credit rating agency.