The Federal Reserve will conclude its two-day policy meeting in Washington, D.C., today. Most market participants expect it to scale back its program to purchase $85 billion of bonds each month. But the reason is not the economy.

Goldman Sachs chief economist Jan Hatzius expects a reduction of purchases of $10 billion to $15 billion. The Fed’s quantitative easing (QE) program first launched in December 2008 has artificially lowered mortgage rates, therefore putting a floor underneath the housing market.

The purchase of Treasury securities has enabled the federal government to deficit spend and stimulate the economy. During the process, the Fed has accumulated 31.59 percent of Treasury bonds outstanding, a whopping $3.6 trillion as of Aug. 24.

In theory the tightening in monetary policy should come on the back of improving economic data, which has been the case. On the other hand, the government deficit has decreased substantially, limiting the supply of Treasury bonds to the market.

Given that the Fed is the largest owner and buyer of Treasury bonds, a limit in the supply will reduce the availability to private buyers of Treasurys and therefore the proper functioning of the U.S. government bond market.

By relaxing its purchases by a reasonable amount, the Fed will allow private bidders to soak up the supply at reasonable prices. If the U.S. government needs to spend again, the Fed can always increase purchases again. The current version is limited by certain metrics of inflation and unemployment, which would trigger an end to the program. These metrics haven’t been reached yet.

Fed’s Taper Reason Is Not the Economy

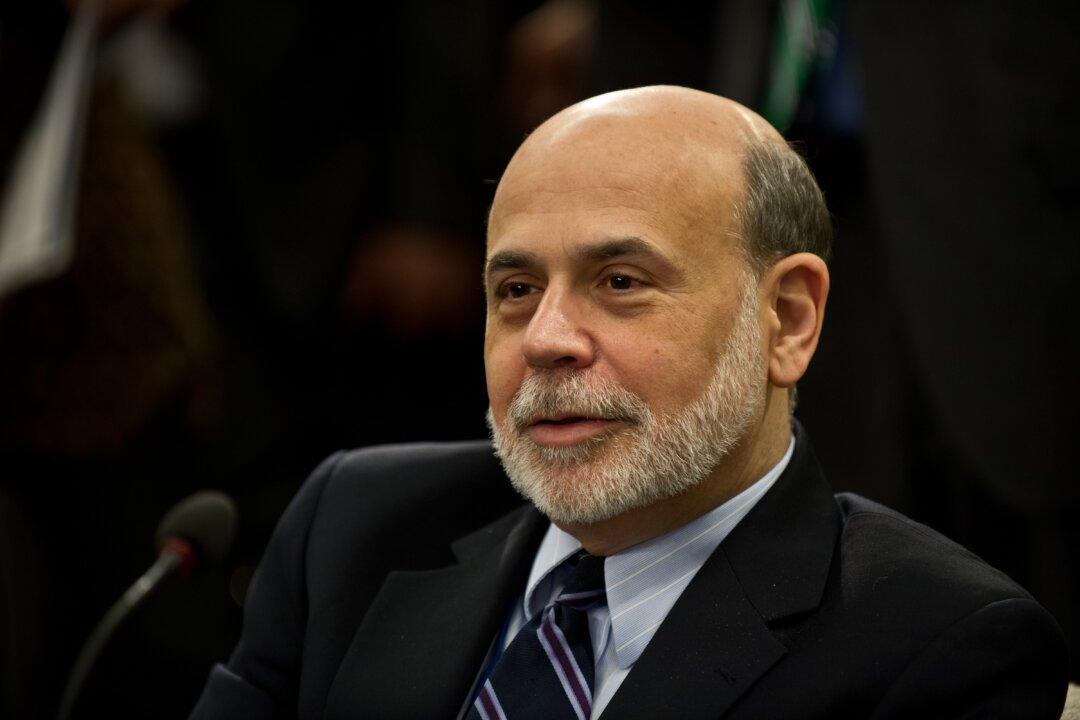

U.S. Federal Reserve chairman Ben Bernanke attends a meeting during the 2013 World Bank/IMF Spring meetings in Washington, D.C., on April 20. Nicholas Kamm/AFP/Getty Images

|Updated:

Valentin Schmid is a former business editor for the Epoch Times. His areas of expertise include global macroeconomic trends and financial markets, China, and Bitcoin. Before joining the paper in 2012, he worked as a portfolio manager for BNP Paribas in Amsterdam, London, Paris, and Hong Kong.

Author’s Selected Articles