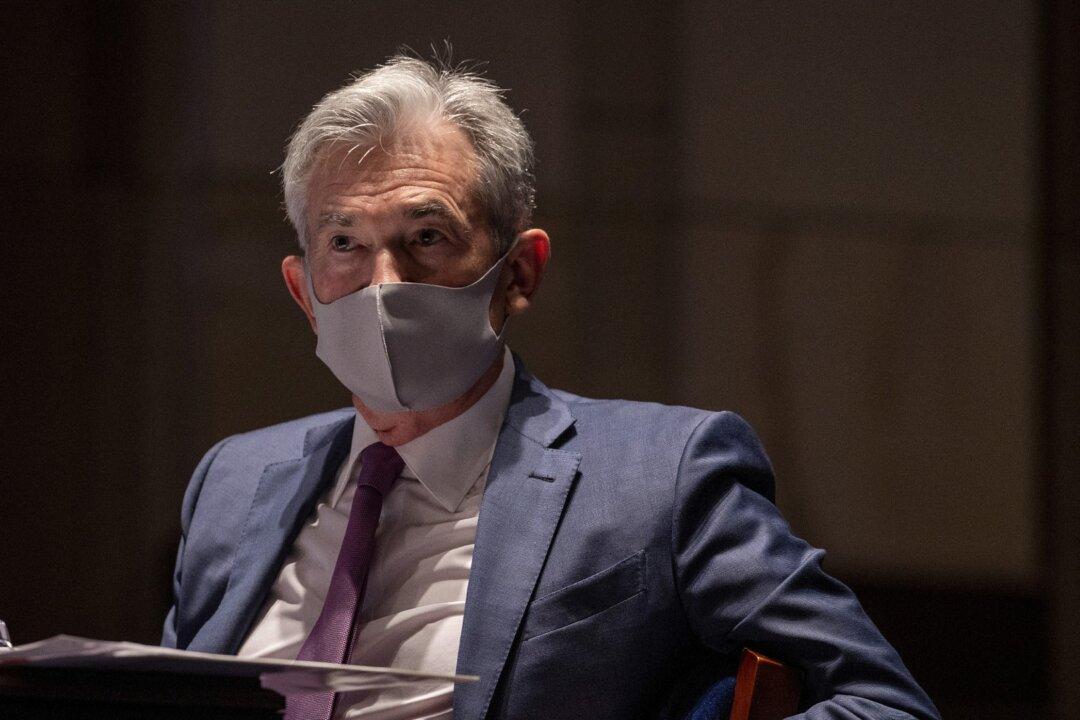

WASHINGTON—Federal Reserve Chair Jerome Powell said on Feb. 23 that the ongoing COVID-19 vaccinations could help speed a return to normal activities later this year, but also warned that the U.S. economic recovery from the pandemic still “remains unequal and far from complete.”

Speaking to the Senate Banking Committee, Powell offered a more optimistic view about the economy than he has in recent statements and signaled that growth in 2021 could be much higher than projected.