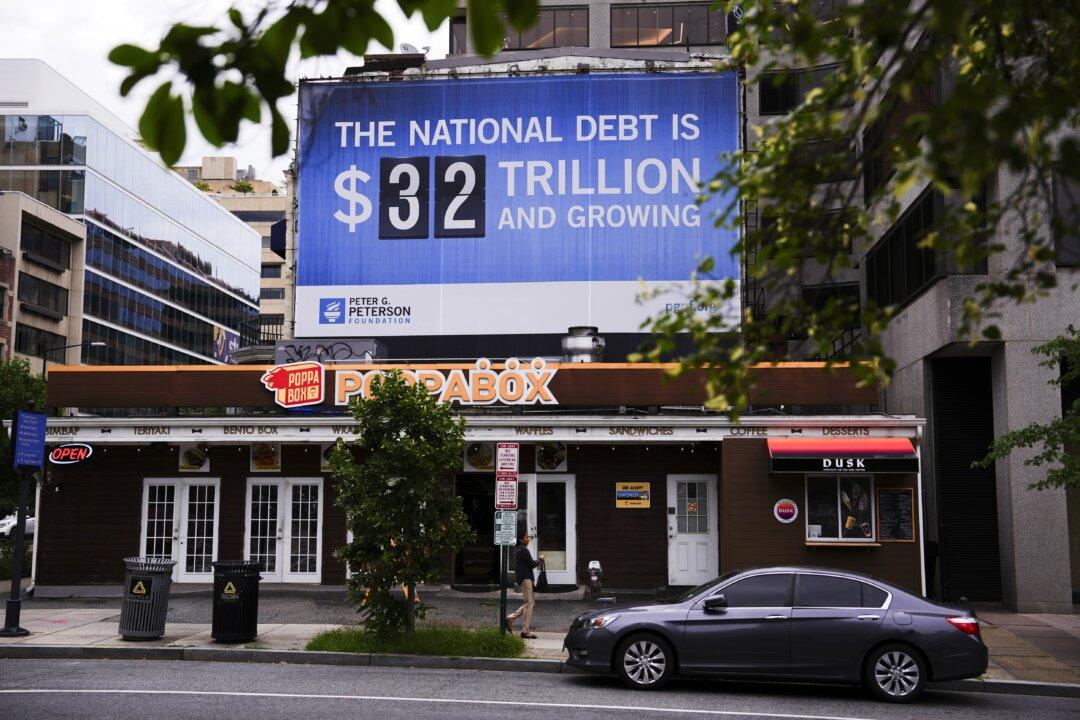

The national debt eclipsed $33 trillion on Sept. 15, while the budget deficit is on track to reach $2 trillion in the current fiscal year. Experts say that the public is becoming numb to these figures because they’ve become the new normal in Washington.

But while soaring debt and deficits are the status quo in the nation’s capital, economists are combing through the books to assess the U.S. government’s fiscal condition.