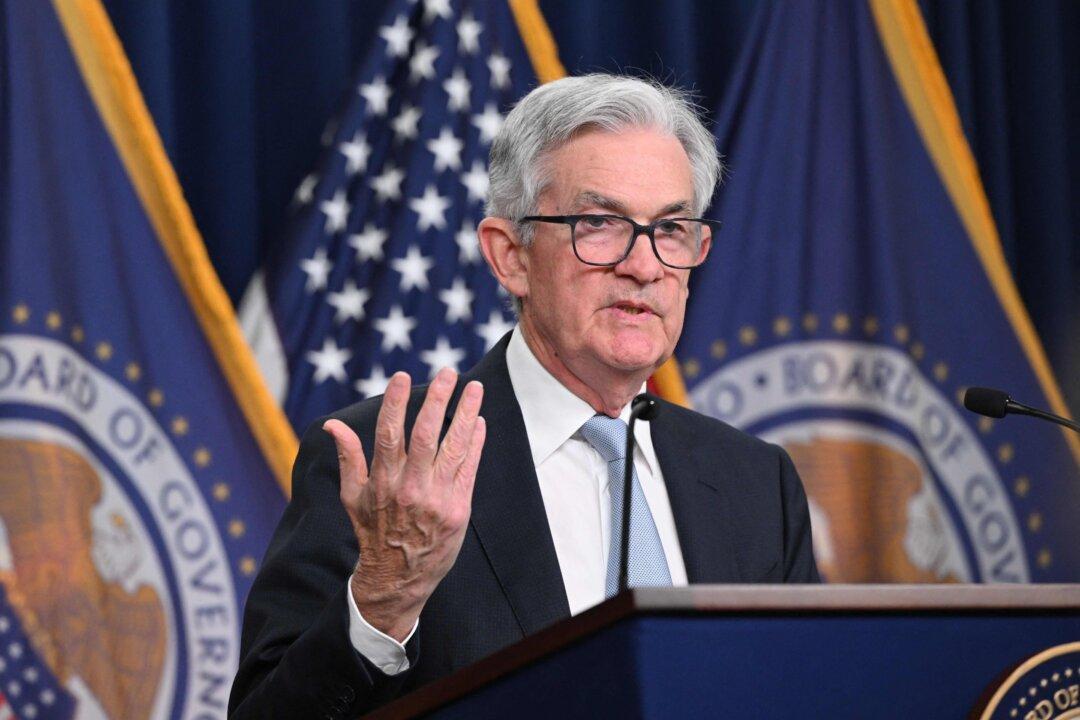

The Federal Reserve has been aggressively moving to raise interest rates this year in an effort to cool off red-hot inflation that has seen the cost of living across the United States soar.

Prior to March of this year, the central bank, whose duties include maintaining a stable monetary and financial system while maximizing employment, had not increased interest rates since 2018.