For the first time, the federal government will begin overseeing credit bureaus. As outlined in the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Consumer Financial Protection Bureau (CFPB) will gain new powers over non-bank financial service providers. The CFPB on July 16 announced the new rules, which will start in September.

“Credit reporting is at the heart of our lending systems and enables many of us to get credit, afford a home, or get an education,” CFPB Director Richard Cordray said in a statement issued by CFPB. “Supervising this market will help ensure that it works properly for consumers, lenders, and the wider economy. There is much at stake in making sure it is both fair and effective.”

CFPB will review the performance of credit reporting companies that have accrued $7 million or more in annual receipts. There are about 30 bureaus that size or larger, which account for about 94 percent of the market, according to CFPB.

Credit bureaus monitor nearly every American adult, and the information they collect and share affects people’s lives.

False information on a credit report can prevent a person from qualifying for a car loan or mortgage, and it can spike the costs of a loan. Apartment leasing agents and hiring managers can check credit reports and reject an applicant due to unfavorable data, even if it is a mistake.

False information creeps onto credit reports in many ways.

Federal Agency to Monitor Credit Bureaus

Credit bureaus monitor nearly every American adult, and the information they collect and share affects people’s lives.

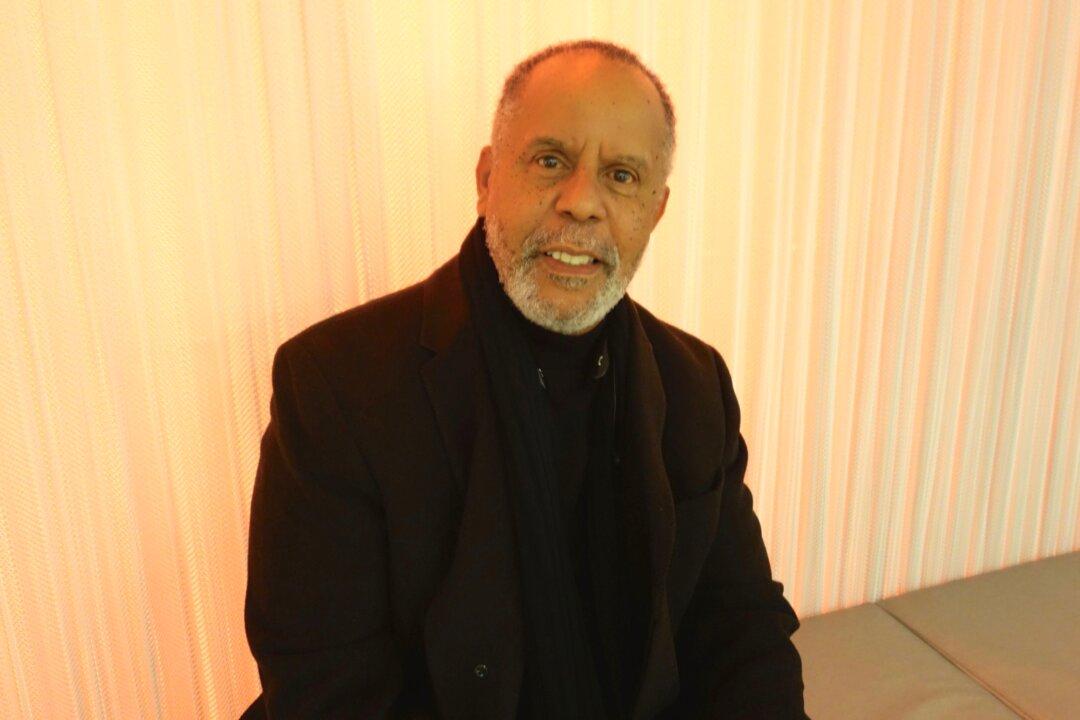

In this file photo, Richard Cordray, incoming head of the Consumer Financial Protection Bureau, stands offstage after President Barack Obama spoke in Shaker Heights, Ohio on Jan. 4. Saul Loeb/AFP/Getty Images

|Updated:

Mary Silver writes columns, grows herbs, hikes, and admires the sky. She likes critters, and thinks the best part of being a journalist is learning new stuff all the time. She has a Masters from Emory University, serves on the board of the Georgia chapter of the Society of Professional Journalists, and belongs to the Association of Health Care Journalists.

Author’s Selected Articles