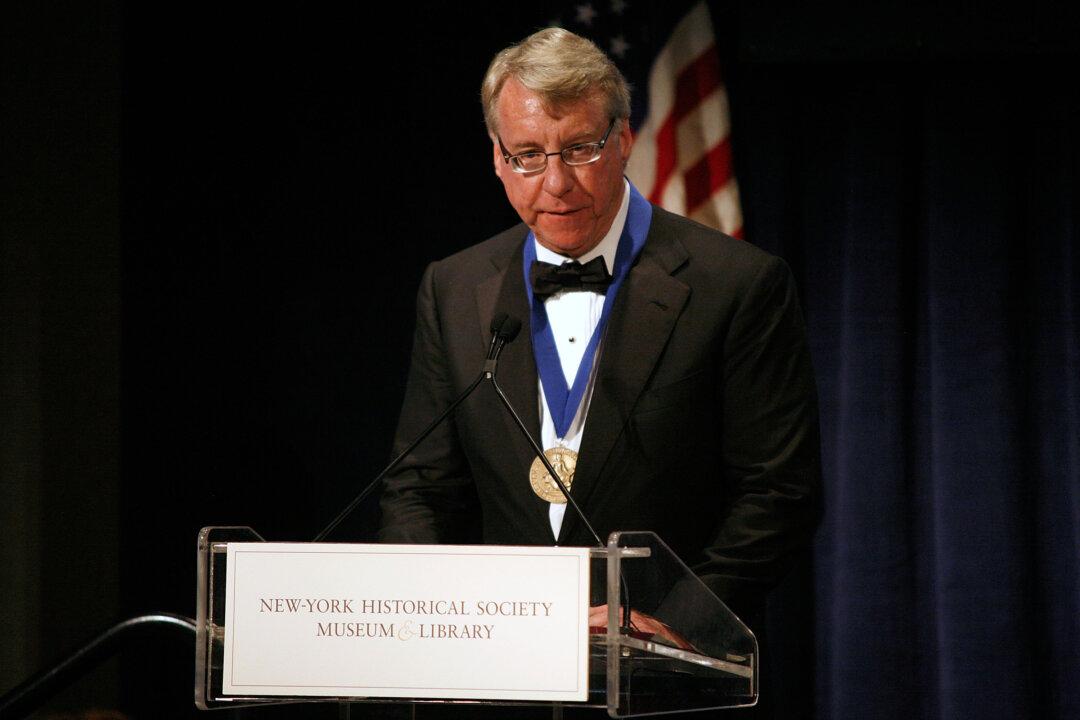

James Chanos, founder of Kynikos Associates LP, first noticed China’s real estate bubble in 2009. He has then correctly anticipated the slow-down in the Chinese economy, which started in 2010. Now he has more bad news for people banking on reforms to save the day.

“The trend is unmistakable. It’s down. Surprises are going to be on the downside,” he said at a panel discussion at The China Institute in New York on Sept. 22.

He convincingly dispelled notions the economy is transitioning from an investment led growth model to a consumer-driven one.

They'll have to go through their credit event.

, Kynikos Associates