Metaphors are multiplying as fiscal cliff discussions continue. Resolving the issue by the Dec. 31 deadline seems unlikely, yet it could be a fiscal bungee jump if legislators “go over, but there is a deal in the making,” said Jared Bernstein, senior fellow at the Center on Budget and Policy Priorities.

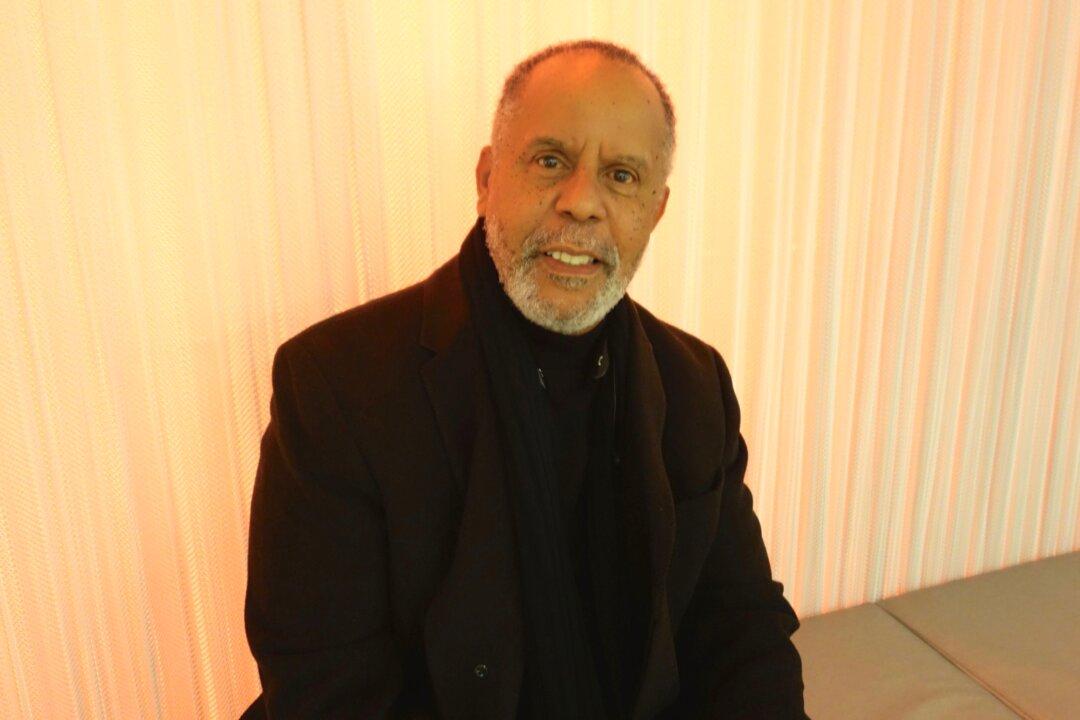

“If we go over and stay over, I suspect the economy will have a negative effect quickly, with the unemployment rate starting to rise as soon as the first quarter of 2013,” said Bernstein. He spoke at a Dec. 13 press teleconference sponsored by New America Media.

Unemployment is not getting as much attention as it should in Washington, according to Bernstein. “There is a real lack of recognition among negotiators that there is a problem out there.”

If more people had jobs and revenue, the tax base would be better, and the strain on social services would lessen. Yet “some people are not looking outside of their own situations,” he said. “They have good jobs and don’t know many people who don’t.”

There are detailed, complex things that need more time and discussion, and then there are simpler things that could be resolved quickly.

Letting the tax cuts expire now should be one of the simpler things, according to Bernstein. It would not have to affect middle-class earners until they file their 2013 taxes in April of 2014, and Congress could hold off on adjusting withholding in order not to shrink people’s take-home pay. They could then repeal the middle-class tax hikes before April 2014.

“We really have to walk and chew gum at the same time,” said Bernstein.

Complicated things include adjusting Medicare and changing how cost-of-living increases are calculated for Social Security recipients. Those things should be worked out thoughtfully over time, according to Bernstein.