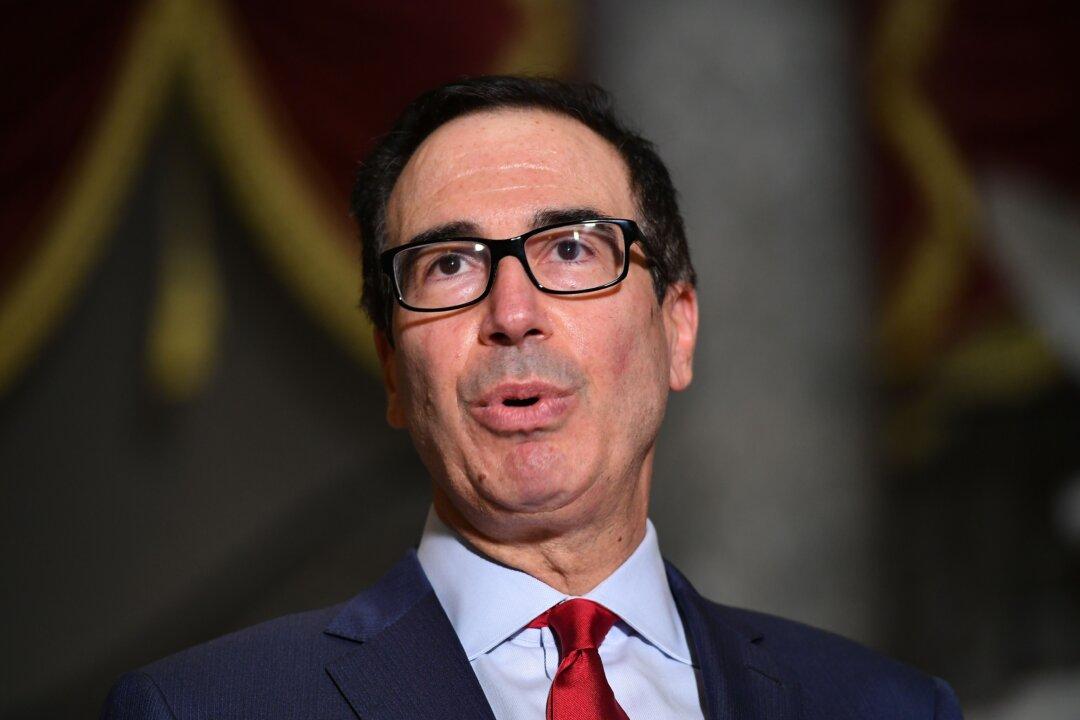

Former U.S. Treasury Secretary Steve Mnuchin has weighed in on the recession debate, stating that he believes the United States is already in the midst of an economic downturn that will continue for the next two years.

Speaking at Saudi Arabia’s Future Investment Initiative (FII) conference in Riyadh on Wednesday, Mnuchin, who served under President Donald Trump’s administration from 2017 to 2021, said he expects 10-year Treasury yields, the most followed benchmark for interest rates, to peak at 4.5 percent.