WASHINGTON—Plastic buckets from the Czech Republic imported into the United States with the declared price of $972 per bucket! Toilet tissue from China imported at the price of over $4,000 per kilogram! Bulldozers exported to Colombia at $1.74 each!

These suspicious-looking prices were cited by one of the witnesses testifying at a congressional hearing, Feb. 3, on money laundering and terrorist financing. They could represent the transfer of value into and out of the United States via trade goods. They could also be just innocent clerical errors. The data is not new and originally came from a study of U.S. trade data by Florida International University professor John Zdanowicz.

Learning how to understand and disrupt money laundering of terrorist organizations has been the aim of a task force that was created by the House Financial Services Committee in March 2015. Called the Task Force to Investigate Terrorism Financing, it has held five hearings and several briefings. Bipartisan, it consists of 21 congressional members.

Money laundering occurs through the financial system, or the smuggling of cash from one country to another, or the physical movement of goods through the trade system. These three methods are delineated by the Financial Action Task Force on Money Laundering (FATF) that was established by the G-7 Summit held in Paris in 1989.

The third one, the physical movement of goods through the trade system, has come to be known as Trade-Based Money Laundering (TBML).

In the aftermath of the Sept 11 attacks, the nexus between finance money laundering and terrorist financing came into focus. Today, efforts that come under the rubric of countering terrorism financing (CTF) have the objective of cutting off funding to terrorist organizations and eradicating their support networks.

At the hearing, the Task Force to Investigate Terrorism Financing wanted to take a closer look at TBML and CTF. Among the forms of money laundering, TBML has received very little attention, yet it is perhaps the largest and most pervasive money laundering methodology, according to the witness John Cassara, a former U.S. intelligence officer and Treasury special agent. He said that it was surprising that we in the United States haven’t focused more on TBML, “because annually, we are possibly losing billions of dollars in lost taxes to trade-mispricing alone.”

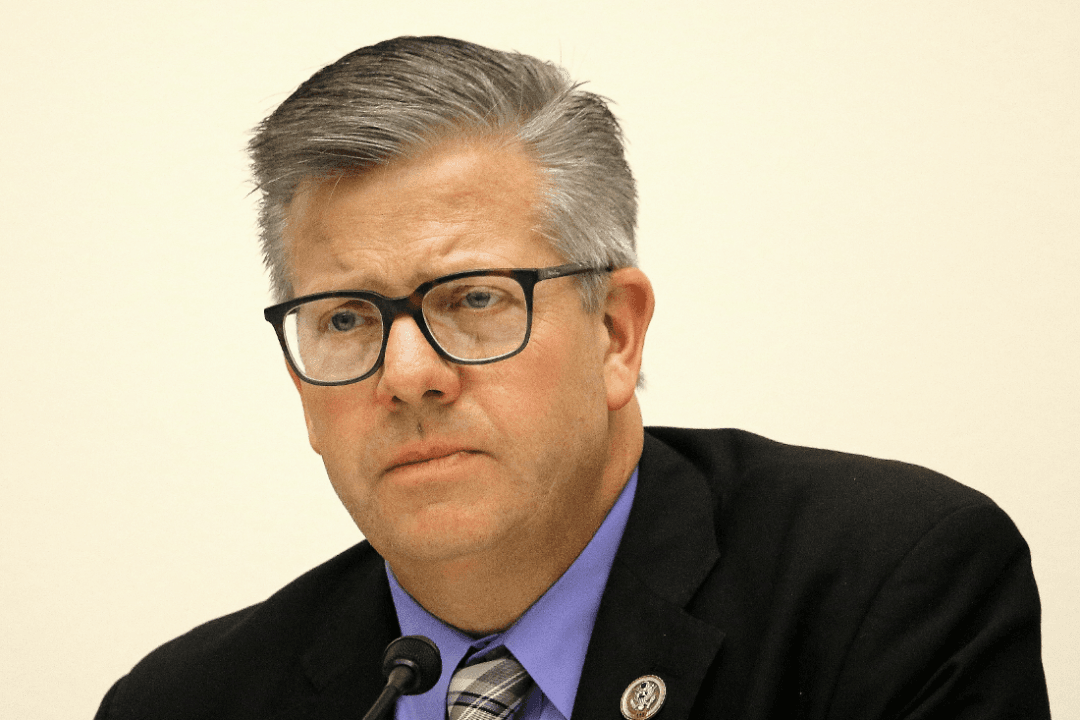

Task Force Chairman Michael Fitzpatrick (R-Pa.) in his opening statement defined TBML as “the process of disguising the proceeds of the crime of moving value through the use of trade transactions in an attempt to legitimize their illicit origin.” This was the same definition given by the FATF.

The timing of the hearing was especially apropos. Fitzpatrick observed that only two days before, the United States Drug Enforcement Administration (DEA) had announced the arrest of members of a Hezbollah group involved in the international crime of drug trafficking and drug proceed money laundering, which was used to purchase weapons for Hezbollah’s activities in Syria.

Hezbollah, of course, is listed as a foreign terrorist organization by the U.S. Department of State.

Trade, Weakest Link in Anti-Money Laundering

John Cassara testified that not long after the Sept. 11 attacks, he had a conversation with a Pakistani businessman involved in illicit finance. The man told him, “Mr. John, don’t you know that your adversaries are transferring money and value right under your noses? But the West doesn’t see it. Your enemies are laughing at you.”