The crème de la crème of the world’s haute finance meet every year at The World Economic Forum (WEF) annual meeting in Davos, Switzerland.

The theme of the meeting this year is “Mastering the Fourth Industrial Revolution,” which the WEF characterizes as follows: “A fusion of technologies that is blurring the lines between the physical, digital, and biological spheres.”

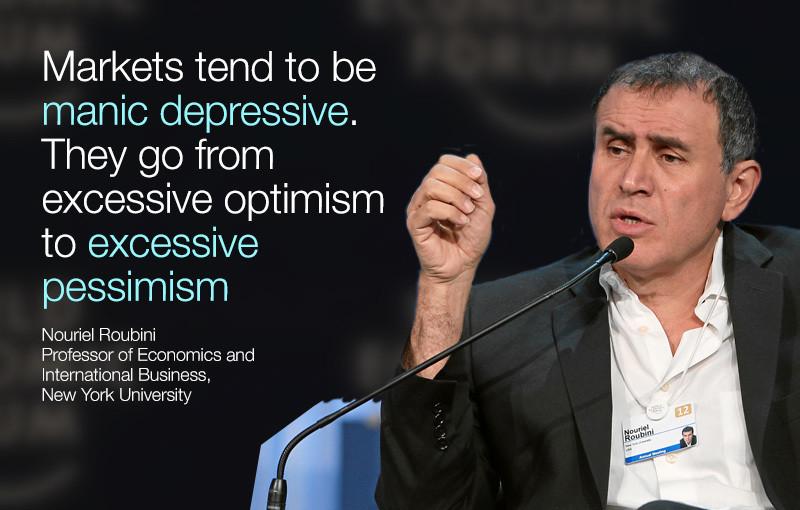

Inspite of this theme, the forum did not get around talking about China, which seems to be stuck somewhere between the second and third industrial revolution. However, in the discussion, the analytical lines of economist Nouriel Roubini, International Monetary Fund managing director Christine LaGarde, hedge fund manager Ray Dalio also got blurred.

Word Economic Forum

Valentin Schmid is a former business editor for the Epoch Times. His areas of expertise include global macroeconomic trends and financial markets, China, and Bitcoin. Before joining the paper in 2012, he worked as a portfolio manager for BNP Paribas in Amsterdam, London, Paris, and Hong Kong.

Author’s Selected Articles