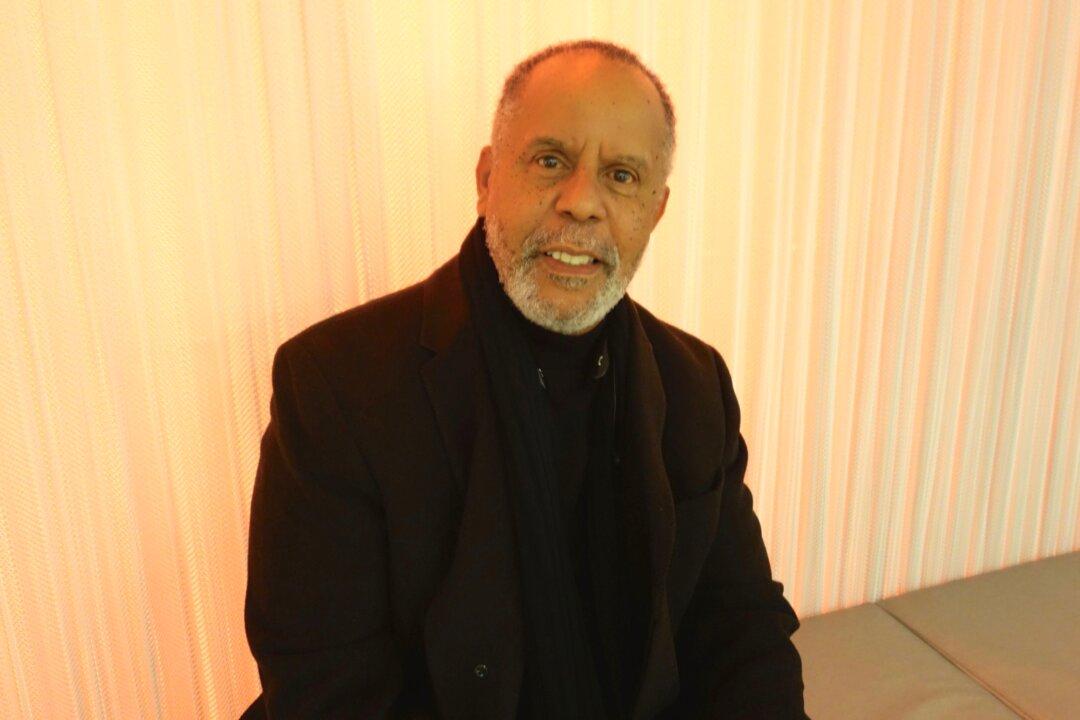

House Minority Whip Steny Hoyer (D-Md.) said, “If you have ten problems, one is still worth solving,” speaking on Congress possibly passing legislation to avert Dec. 31 tax increases for individuals with annual incomes up to $200,000.

At a Dec. 27 press conference broadcast on C-Span, Hoyer said that voting on that one issue could “show the country that Congress can work.”

Members of both parties agree that the tax rates on families with incomes up to $250,000 and individuals with incomes up to $200,000 should not return to pre-2000 levels—yet they have not managed to create and pass legislation to avoid it.

“We have four days,” said Hoyer.

The nickname of “fiscal cliff” is dire, but the actual effects of going over the legislative cliff would be both gradual and correctable—in most cases.

One exception is Emergency Unemployment Compensation (EUC), extended unemployment insurance, which would end abruptly for the long-term unemployed. It is due to stop Dec. 29.

States with unemployment above a certain level are now receiving federal money to cover unemployment for long-term jobless people. Millions of people could lose the small stipend, according to Hoyer.

The nonpartisan Congressional Budget Office (CBO) issued a report in November titled, “Unemployment Insurance in the Wake of the Recent Recession.” According to The Hill congressional newspaper, “[The report] found that extending the unemployment program through next year would create 300,000 jobs and boost economic growth by 0.2 percent in the fourth quarter of 2013.”