WASHINGTON—Members of the U.S.-China Economic and Security Commission, an advisory group to Congress on China, are calling for a reconsideration of the United States’ long-held China policies, citing widespread disappointment over China not moving toward becoming a free market economy.

On Nov. 16, the Commission’s annual report—a 550 page book—was released, and several commissioners discussed their key findings and recommendations and answered questions from the public.

“The Commission believes it’s time to reconsider U.S. policy towards China guided by its kind of actions, not by its words,” Vice Chairman Carolyn Bartholomew said.

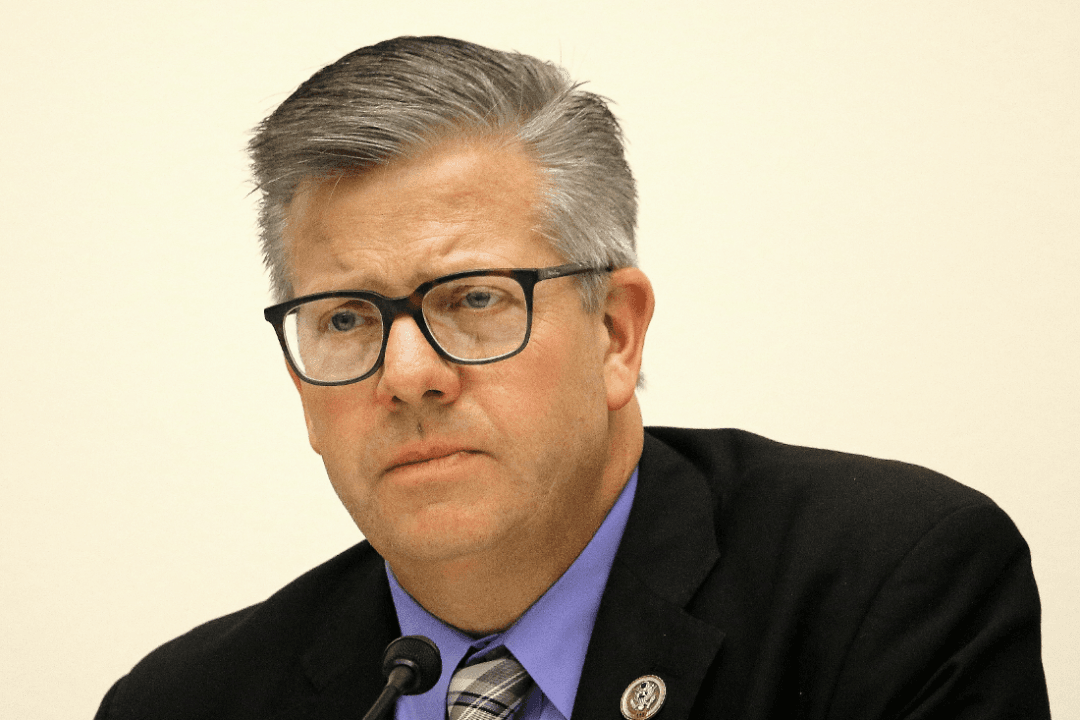

Commission Chairman Dennis Shea said the Commission had conducted several public hearings and briefings, sponsored research, and went on fact-finding trips to China, Taiwan and India in the past year. The result is a tome of rich detail concerning U.S.-China trade, China’s state-owned enterprises (SOEs), China’s military modernization, China’s “force projection” and “expeditionary” capabilities, espionage threats to the United States, Taiwan, Hong Kong, North Korea, and the U.S. “rebalance” to Asia.

At the public release of the report, two topics dominated the Commissioners’ concerns and questions asked by the press and interested China watchers: trade imbalance and state-owned enterprises (SOEs).

Trade Deficit, Overcapacity Promises

The U.S. goods trade deficit with China in 2015 reached $365.7 billion, an increase of 6.5 percent from the previous year and the highest on record. The cumulative trade deficit with the U.S. since China’s accession to the World Trade Organization (WTO) fifteen years ago is “a staggering $3.5 trillion,” states the report.