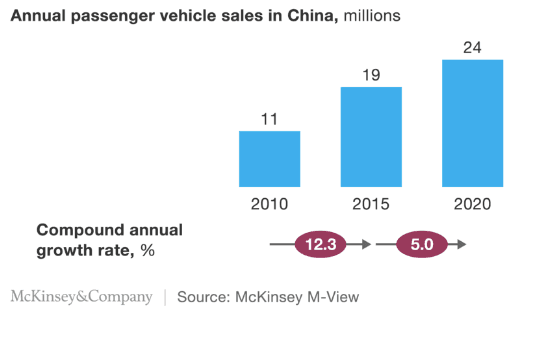

After years of double-digit growth, China’s automobile market is slowing. According to a new study by McKinsey, the world’s largest auto market will grow only 5 percent annually until 2020.

The weak economy hurts auto sales. In addition, a change in consumer behavior is affecting the automotive sales in China.

“Changing consumer attitudes and macroeconomic headwinds are slowing growth in China’s vehicle market. From 2010 to 2015, vehicle sales in China increased by more than 12 percent a year. Looking out to 2020, however, we project that the vehicle market will grow by an average of 5 percent a year,” stated the McKinsey report.

Car prices in China have fallen 4 percent each year over the past decade due to intense competition among automakers. But despite the widespread price cuts, monthly new car sales fell sharply in the first three quarters of 2015 as the economy slowed.

However, carmakers benefited by a tax reduction on vehicle purchases from October 2015, which will last until the end of 2016. The Chinese government cut the purchase tax on vehicles with engines of 1.6 liters or smaller to 5 percent in an effort to boost car sales.

With the tax break, monthly sales picked up in the final quarter of 2015 and the trend continued through the first months of this year.

Sales of passenger cars climbed 6.7 percent in the first four months of 2016, according to a Bloomberg report. However, experts warn that short-term policies like tax cuts merely shift demand forward. Car shoppers are expected to buy this year and not next, leading to a downturn in 2017 after the policy expires.