Professor R.A. Henderson, a panel member of Earth Sciences at the Australian Research Council said rare earth metals are important and market demand will weaken China’s hold on the resource sector.

“It will be very difficult to lock up these metals,” he told The Epoch Times, “If prices move up other producers will come in.”

Rare earth metals are crucial to range of 21st century industries including computers, lasers, satellite communications, mobile phones and a gamut of environmental technologies.

China has substantial reserves through its mines in Inner Mongolia but has, over the last 20 years, been knocking out competition while expanding its own production.

With demand increasing for technologies requiring rare earth metals, the communist run state has indicated it will reduce exports of some of the metals and cease export altogether for a range of others.

China’s central Ministry of Industry and Information Technology released a draft report last month entitled ‘Rare Earths Industry Development Plan, which it submitted to the State Council for review and implementation in 2010.

The report outlines plans to further tighten Chinese exports beyond the current 35,000 tons of rare earth metals and to impose a complete ban on a number of specific metals including Dysprosium (Dy), Terbium (Tb) and Yttrium (Yt).

Dysprosium is critical to the enhancement of magnets in the electric systems of hybrid and electric vehicles. The metal’s property improves magnetic performance that is essential in electric car technology. Terbium and Yttrium are dominantly used as phosphors in energy efficient lights.

Professor Henderson said China might be able to manipulate the market for a time but demand will stimulate more interest in the area making it difficult for China to maintain its hold.

“They can attempt to manipulate market forces to their own advantage, for national interest but to lock up those commodities is a bit improbable,” he said.

That may be the case but it will not be without trying

Australia

Rare Earth metals are available in other countries particularly the US, Russia, South Africa and Australia but processing is expensive, dirty and complex, and produces a small amount of radioactive waste.

China with its scant regard for environmental concerns, has over the last decade, been able to expand its own mines while undercutting competition, in many cases forcing closure.

In Australia it is attempting to go one step further and buy up the holdings.

Australian company, Lynas Corp, which owns Mt Weld in Western Australia, considered one of the richest deposits of rare earths in the world, originally processed its Mt Weld metals in China.

However with China increasing its focus on the sector Lynas began to get nervous saying, “Increasing Government control of the Rare Earths industry in China,[was] increasing the project risk for our plant.”

The company entered into negotiations with the Malaysian Industrial Development Association (MIDA), to start up a factory in Kuantan, in the state of Pahang.

MIDA offered attractive conditions and benefits including a 12 year tax free period but the deal was scotched when China Non-Ferrous Metal Mining became a majority shareholder.

The second most developed rare earth mining company, Arafura Resources is also heavily entwined with China.

East China Exploration owns 25 per cent of that.

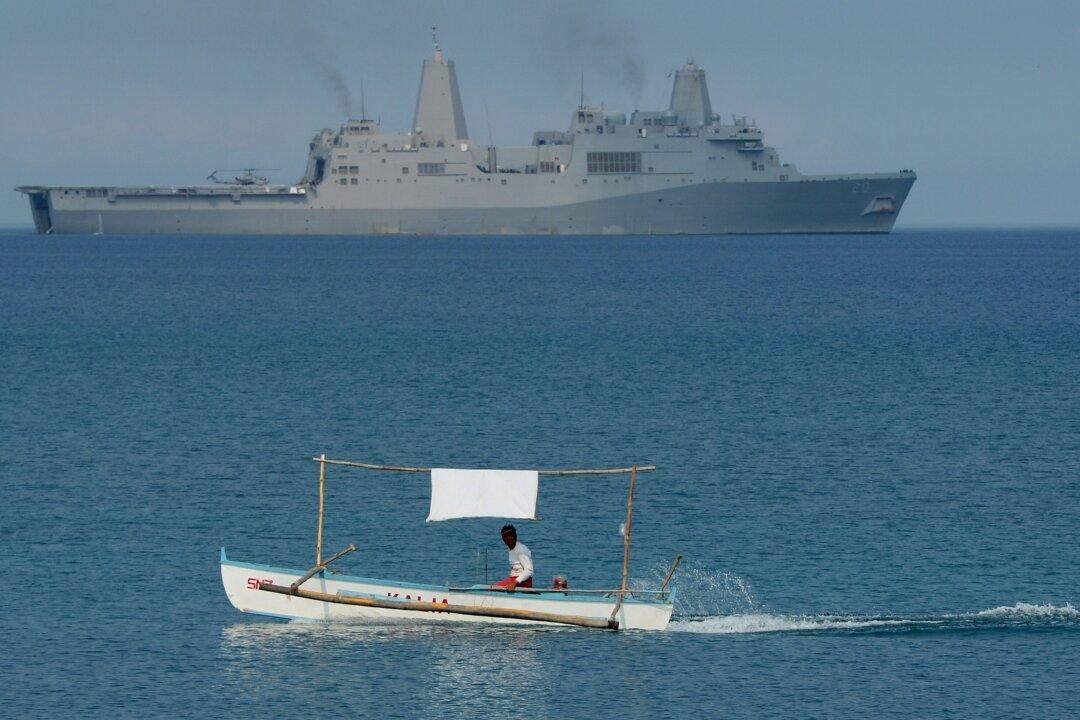

Even if China ties up some of its competitors however, others are not taking it lying down. Japan who relies heavily on are earth metals to sustain its big investment in environmental technology, particularly hybrid cars, is already seeking alternative supplies.

It is understood that Toyota alone is seeking other rare earth sources in Canada and Vietnam