The central bank of China probably regrets having released this one last data point before the Chinese New Year on Feb. 8. The celebrations could have been so much nicer without it.

Some analysts estimated Chinese intervention in the currency markets in January was as high as $185 billion, intervention that burns through China’s foreign currency reserves.

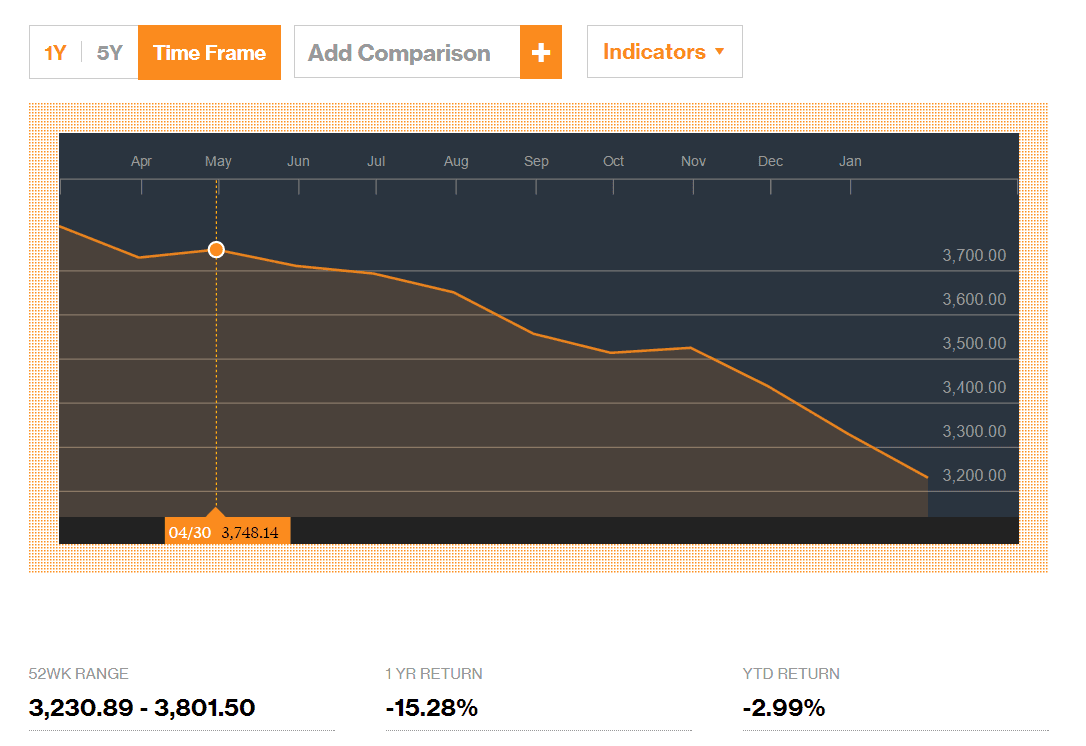

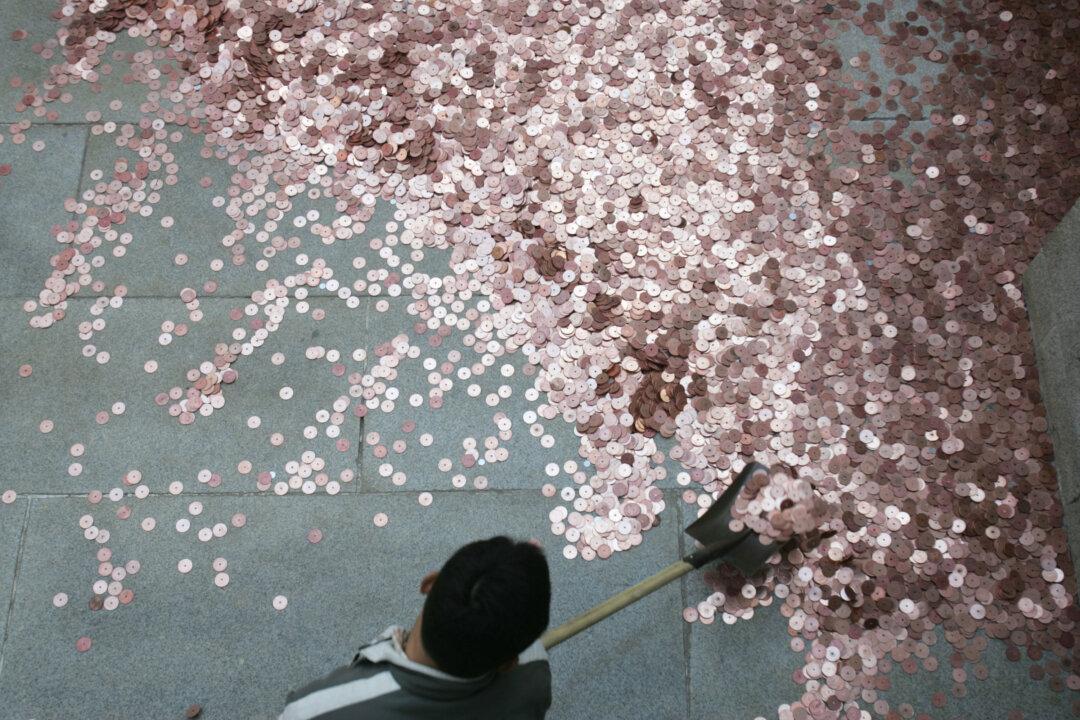

According to the latest data released by the People’s Bank of China (PBOC) just before the new year, these estimates were a bit too high, but still. China lost $99.5 billion of its foreign exchange stash, which now totals only $3.23 trillion.

There were several hints that China would bleed more reserves in January, which is not exactly the same as intervention in the currency markets but is a good indicator. For instance, the PBOC pushed $233 billion into the domestic financial system in January.