Commentary

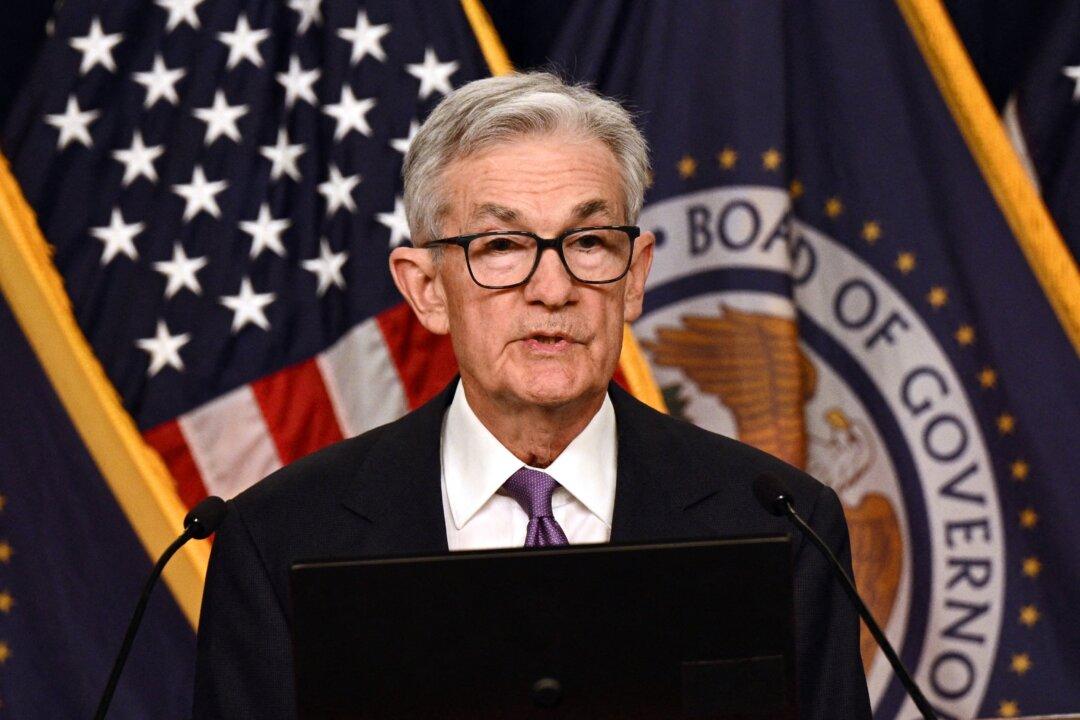

The Department of Labor announced last Tuesday that the Consumer Price Index (CPI) rose by 0.1 percent in November and 3.1 percent in the past 12 months. Core CPI, which excludes volatile food and energy, rose 0.3 percent in November and 4 percent in the past 12 months. Food prices rose 0.2 percent, and energy prices declined 2.3 percent, due largely to a 6 percent decline in gasoline prices. Natural gas and propane prices rose 2.8 percent in November due largely to colder weather. Owners’ equivalent rent (shelter costs) rose 0.4 percent in November and 5.5 percent in the past year. This was a bit disappointing, so the Federal Reserve will keep rates steady until inflation approaches its target of 2 percent.