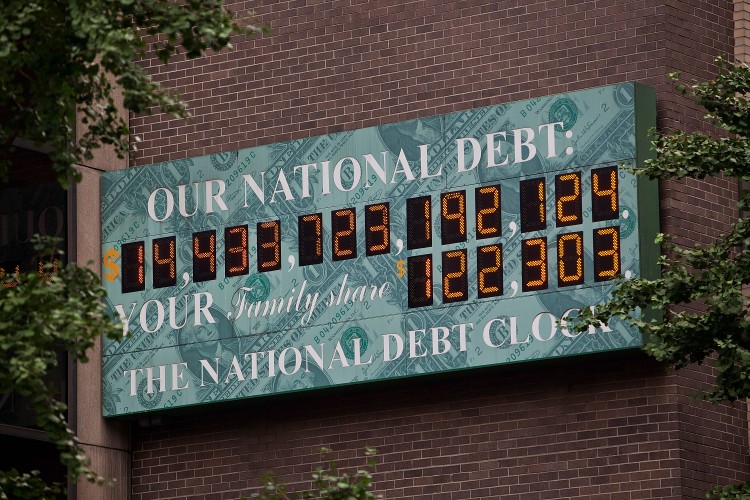

The Congressional Budget Office warned of explosive growth in national debt if current, unsustainable fiscal policies continue. The nonpartisan federal agency released its latest report on the country’s long-term budget outlook on June 5.

By the end of 2012, the deficit will be 70 percent of the gross national product (GNP), the highest it has been since the end of World War II, according to the report.

Whether the dire prediction will come true depends on demographics and policies, it said.

As the baby-boomer generation retires, it will consume more government resources than it gives in taxes. Costs for Medicare, Social Security, and the services for the poor funded by Medicaid, will face a “serious and sustained increase” because of that generation’s departure from the workforce, according to the CBO. Costs for health care will also increase.

The policies contributing to debt growth are lawmakers’ decisions about taxes and spending. The CBO produced two projections.

In the extended baseline scenario, debt would decrease in the coming 25 years, and be about 53 percent of gross domestic product (GDP) in 2037. That takes into account provisions that schedule most current tax cuts to expire, except the payroll tax cut.

The alternative baseline is the doomsday one, which assumes tax policies, spending, and revenues would stay about the same as they are today, while the costs of caring for retiring baby boomers would grow. That estimate does not include the depressing effect such high debt would have on the economy.

According to The Hill, some economists have predicted that if debt approached 100 percent of GDP, the country would suffer the kind of severe disruptions Europe is experiencing today, with rising interest rates, slashed social services, and laid-off government workers.

The new report by the CBO is slightly more optimistic than its 2011 projection. Last year it warned that debt would reach 84 percent of GDP in 2035, based on the extended baseline scenario.

The key problem is that lawmakers may not agree to allow the tax cuts to expire or make changes to entitlement programs. If they do not, that would trigger the worst-case scenario.

“The explosive path of federal debt under the alternative fiscal scenario—which maintains what might be deemed current policies—underscores the need for large and timely policy changes to put the federal government on a sustainable fiscal course,” according to the CBO.

House Budget Committee Chairman Paul Ryan (R-Wis.) said in a statement, “Repeating Europe’s mistakes, the president’s policies call for job-crushing tax increases and harsh disruptions for beneficiaries of government programs as debt spirals out of control.”

The Epoch Times publishes in 35 countries and in 19 languages. Subscribe to our e-newsletter.