Electric Vehicles Become Mainstream Reality

For years, the impetus to go green has called for high-mileage, low-emission vehicles on the road. This year, those aspirations have finally become a verifiable reality. With the introduction of two mass-produced, reasonably priced plug-in electric vehicles that aren’t just marketed to the environmentalists, technology has caught up to consumer demand.

General Motors Co., fresh off a government-assisted bankruptcy, began selling the plug-in electric hybrid Chevrolet Volt in mid-December. The car has a 50-mile range on batteries alone and costs around $40,000 before any tax and manufacturer incentives.

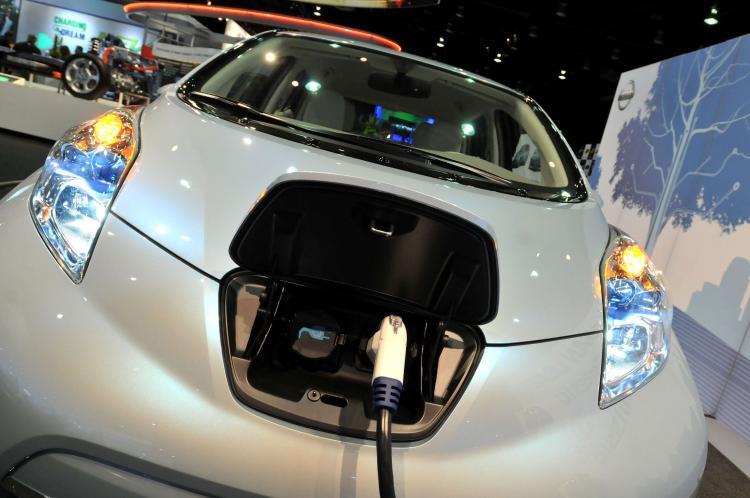

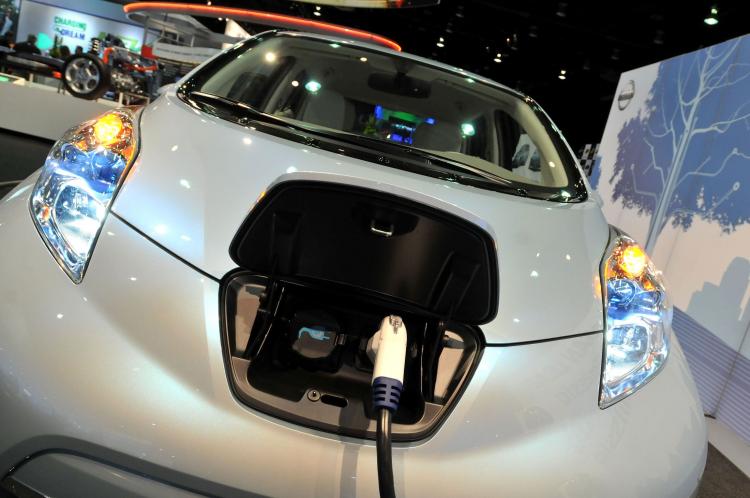

Also this month, Japanese automaker Nissan introduced its much-awaited Nissan Leaf plug-in electric hatchback, which boasts a range of 100 miles per charge. Deliveries for the vehicle began earlier this month in the U.S. market, to be followed closely by Europe in early 2011. As the Leaf is all-electric, it is the first mass-produced zero-emission vehicle.

Tesla, a California automaker focused on electric vehicles, received a federal government loan this year, signed an alliance with Toyota, and became a publicly traded company in September. All signs point to an electric car revolution in the not too distant future, and we may look back on 2010 as the year that started the momentum.

Smartphones and Tablets: Mobile Computing Reaches Critical Mass

A few years is an eternity in the technology world. Not long ago, smartphone was an arcane term, and the only devices remotely resembling today’s powerful half-phone, half-computers were carried by BlackBerry-toting, jet-setting businesspeople.

The smartphone wasn’t invented in 2010, but 2010 marks the beginning of a smartphone explosion with multiple carriers, countless manufacturers, and several well-established operating systems (BlackBerry, Android, Windows Phone 7, and iOS) all competing for consumers’ texting and Web-browsing fury.

For the first time, phones based on Google’s Android OS will outsell Apple iPhones, and each of the four major U.S. wireless carriers sell phones that can objectively boast the features and entertainment value comparable to that of the iPhone. This year, Apple launched its own tablet computer—the iPad—which sold 7.5 million units as of the third quarter, prompting rival manufacturers to launch a bevy of similar devices based on the Android and Windows platforms for mobile Web-browsing and e-book reading.

Such mobile Internet technologies, coupled with the expansion of 3G and 4G wireless service by major carriers in the United States, signal that for the first time, the entire digital world is finally at one’s fingertips.

Dodd-Frank Act Overhauls Financial Industry

President Obama signed into law on July 21 the Dodd–Frank Wall Street Reform and Consumer Protection Act, the most sweeping financial industry regulatory legislation since the Great Depression.

The bill, which overhauls and affects almost every aspect of the U.S. banking industry, affects the $600 trillion financial derivatives market, consumer finance and mortgages, as well as the credit card industry. For the first time, exotic financial derivative instruments—which some analysts say were a main driver of the 2008 financial crisis—are now largely regulated and traded on public exchanges.

Banks are no longer permitted to undertake risky proprietary trading using consumers’ deposits. Under the new laws, financial institutions are required to hold additional capital to withstand future market crises, and a new Consumer Financial Protection Agency was set up to oversee consumer lending, mortgages, credit cards, and debit cards.

Bailed-Out Companies Repay Obligations

In 2008, the Bush administration passed the $700 billion TARP bill to bail out U.S. corporations deemed to be significant for the well-being of the national economy. Two years later, almost all of the major corporations that received U.S. taxpayer funding have repaid their TARP loans, even netting the government hefty profits.

The government’s $45 billion loan to banking giant Citigroup was fully returned this month, with taxpayers netting a $12 billion profit. After needing resuscitation in 2008 and a government-assisted bankruptcy last year, Detroit automaker General Motors Co. last month sold shares in an initial public offering and repaid a portion of its TARP debt.

The U.S. Treasury now holds 500 million shares of GM—a 33 percent stake—and is on track to be fully repaid, with interest, by 2013. Insurer AIG, after spinning off and selling its Hong Kong and Japanese arms, also has a concrete plan in place to repay its U.S. Treasury obligations and return to profitability.

Based on the story of these companies and their recent revivals, it appears that the once-maligned TARP program has achieved its goal.