NEW YORK—The Atlantic Yards development in Brooklyn will be co-developed by a Chinese state-run developer.

Forest City Enterprises Inc. and Chinese developer Greenland Holding Group signed an agreement Dec. 16 for a joint venture, where Greenland will co-develop and own 70 percent of the project.

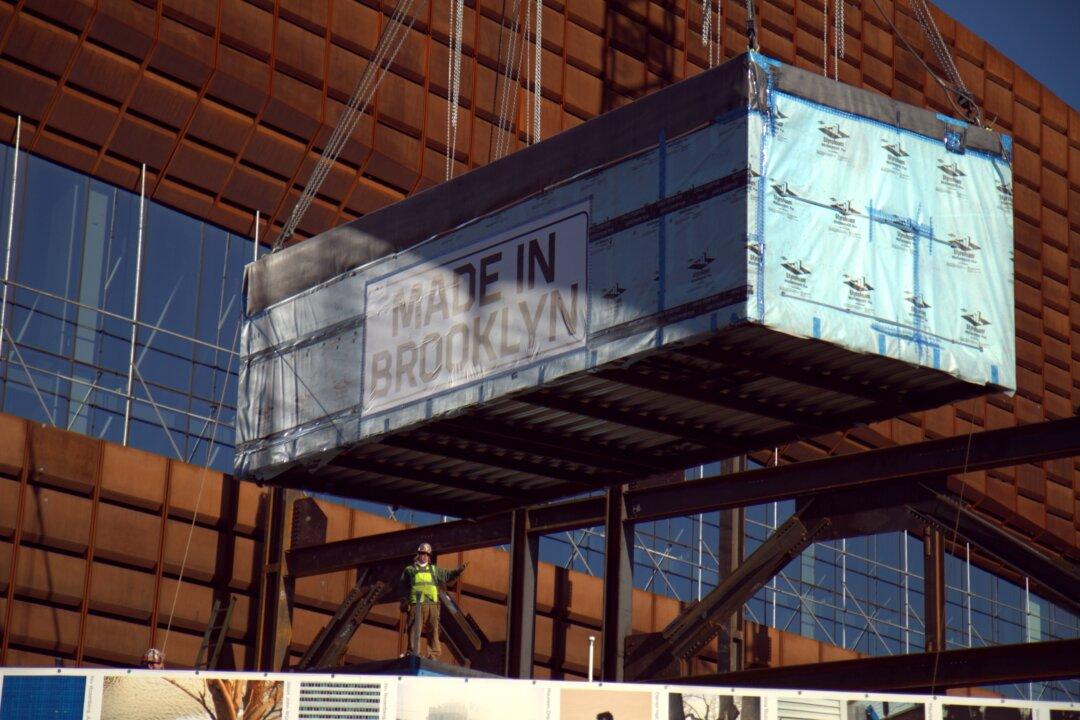

The decade-long project just started stacking modules for its first residential tower on Dec. 12. Besides the already complete Barclay’s Center, there will be 16 towers in total, one of them commercial.

Greenland’s investment in the $4.9 billion project will allow the construction process to speed up. According to Zhang Yulian, Greenland‘s chairman, they now expect the project to be complete in eight years.

The Brooklyn Brand

Brooklyn has become an international brand and it’s no wonder that Chinese developers, who earlier this year invested $1 billion in a Los Angeles project, have taken an interest in Atlantic Yards.

“To do this in Brooklyn, New York, is a dream for all of us at Greenland,” Yulian said.

“Everybody around the world knows Brooklyn,” said Doug Bowen, CORE real estate agent specializing in the western waterfront of the borough. “The restaurant scene has exploded, the music scene has come from Manhattan into Williamsburg, Brooklyn. The retail opportunities have become a lot more layered and varied.”

Rental and real estate prices are escalating dramatically in the neighborhoods along the Brooklyn waterfront and downtown Brooklyn. Buyers and developers are both flocking to the area.

“Brooklyn is the biggest brand coming out of New York City,” Bowen said.

Chinese developers have been committing billions to real estate in the United States in the past year, drawn by stability. Having made fortunes in Chinese real estate, they’re turning to properties in areas like New York, California, and the United Kingdom as Chinese real estate regulations become more complicated.

A dozen Chinese developers gathered in November to tour six cities in two weeks to meet with potential local partners.

“We like the stable and mature investment market in the U.S. relative to the Chinese market,” Jianrong Qian, chairman of Shanghai-based Chiway Holding Group Co., said in Los Angeles, according to Bloomberg Personal Finance. In exchange for this stability, the developers are prepared for returns of about 15 percent, far below the 30-50 percent common in projects in China, Qian said.

Timeline

Community members and elected officials had protested when Forest City announced its intention to sell Greenland a 70 percent stake in the project in October. The community accused the developers of being irresponsible after years of waiting for promised affordable housing units and jobs.

Forest City responded that the cash from the joint venture would allow the construction to progress more quickly and provide the affordable housing and jobs agreed upon.

A coalition of Brooklyn elected officials again called on Forest City Dec. 15, to accelerate the affordable housing component of the project. Atlantic Yards promises 2,250 units of affordable housing. The first of those units are expected to be available in 2015.

“Forest City and others have indicated the Greenland investment will deliver the affordable housing much more quickly, but we expect those commitments to be made in writing as part of the project agreements,” said State Senator Velmanette Montgomery. “And if the development team doesn’t meet its deadlines, the state must require it to compensate the public for any and all delays in the development of the affordable housing. The affordable housing must come now.”

The Atlantic Yards development had a 10-year timeline in 2006 but stalled when the recession hit in 2008. Lack of funds and lawsuits stalled the project further and in 2009, the construction schedule was extended by 15 years.

Bringing an investor into a project late in the game after creating some value is common for Forest City, BMO Capital Markets analyst Paul Adornato told New York Times.

In 2010, when construction was ongoing at the Barclays Center, a part of the Atlantic Yards project, Forest City sold and 80 percent stake in the Nets basketball franchise and a 45 percent stake in the Barclays Center to Russian billionaire Mikhail Prokhorov.

The deal between Forest City and Greenland will close in 2014 and will be Forest City’s largest partnership to date.