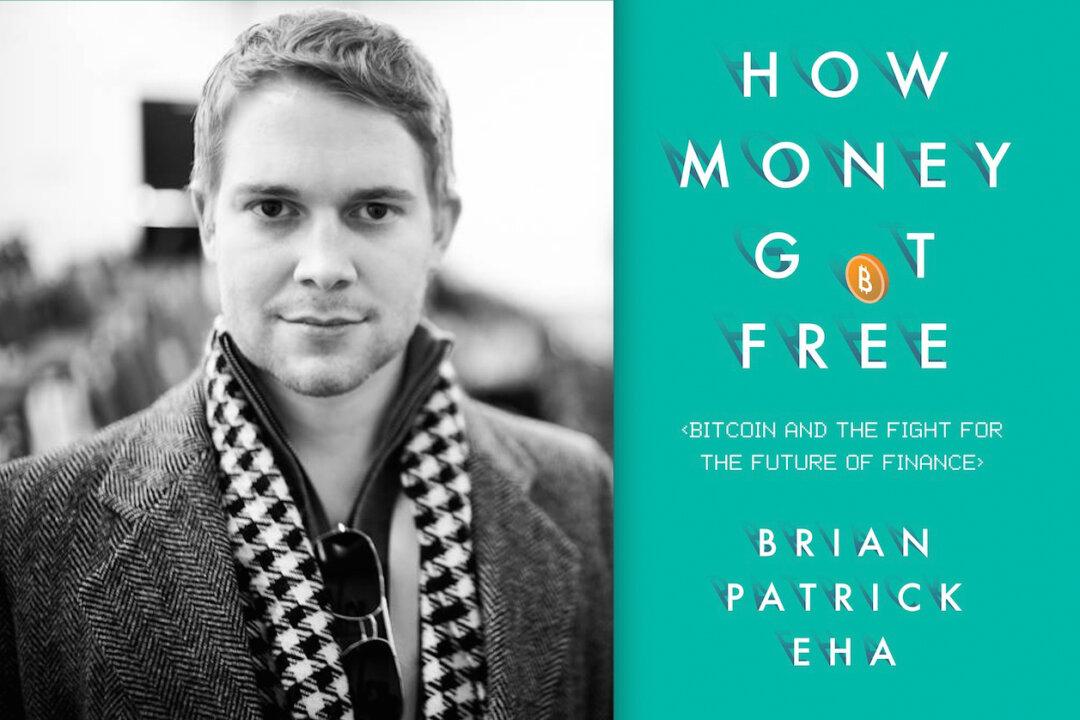

Want to learn everything you need to know about bitcoin, and have fun doing it? Then read Brian Patrick Eha’s definitive history of the cryptocurrency, told through the stories of the individuals and companies who helped to build it, thereby fusing philosophy with technology and individual destinies with the financial revolution of our time.

For most people, the subject of bitcoin seems rather dry—an obscure new technology that pretends to be money and is horribly hard to understand for someone who isn’t a financial expert or a software developer. And yet, with bitcoin now worth almost $70 billion and up 300 percent in 2017, it’s also incredibly interesting and exciting, and something worth knowing and learning about.