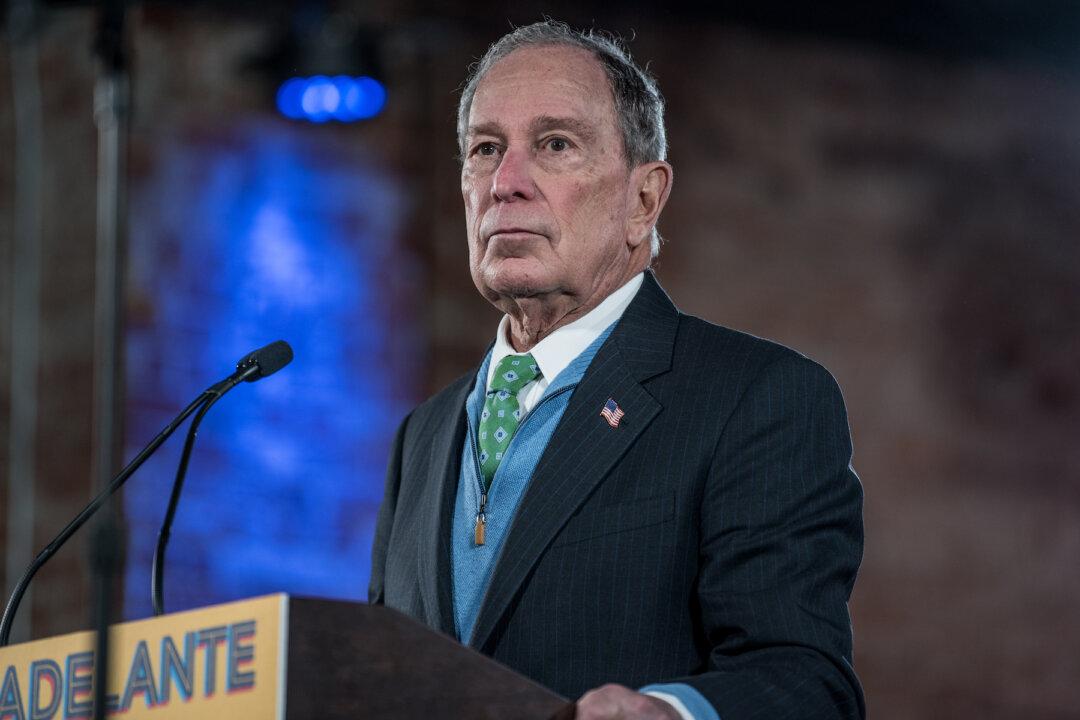

Billionaire Democratic presidential candidate Mike Bloomberg is unveiling a tax plan that would target the wealthy—increasing rates on capital gains and corporate gains as well as introducing a new 5 percent surtax on incomes above $5 million.

Campaign officials, who spoke on condition of anonymity to discuss the details of the tax plan before it is released, said it would raise roughly $5 trillion over 10 years, though that figure could be adjusted higher or lower based on the funding needs of Bloomberg’s policy agenda.