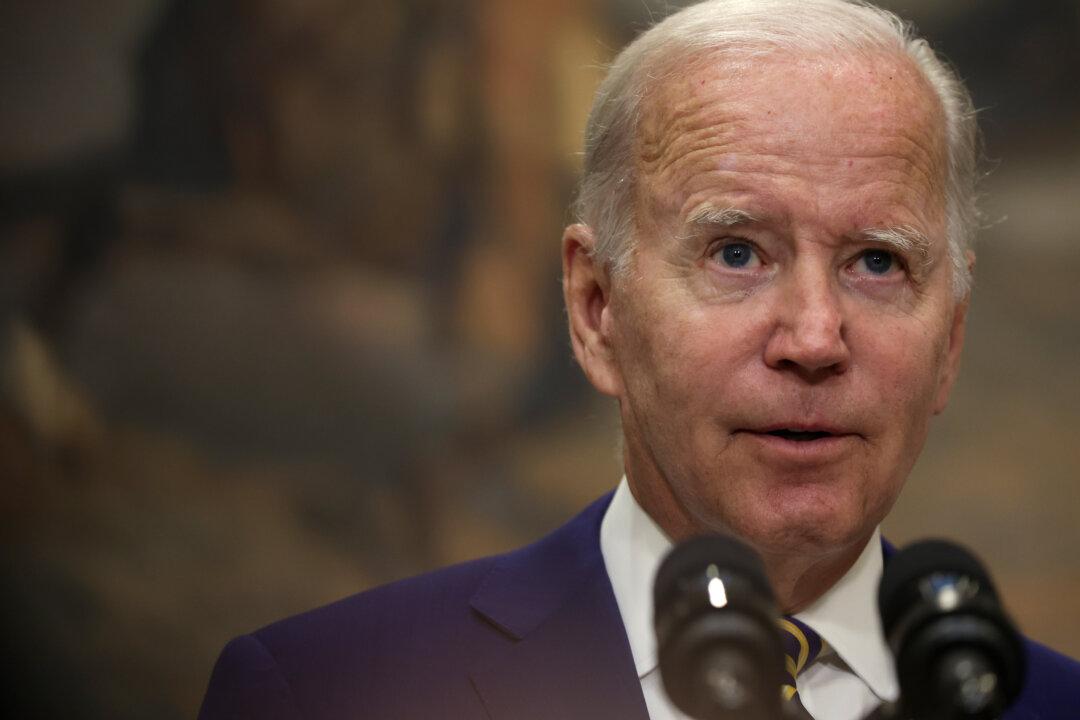

President Joe Biden’s plan to forgive thousands of dollars in student debt for millions of Americans and adjust repayment for others will cost roughly $500 billion, according to a nonprofit that analyzes such plans.

Biden said he'll cancel up to $10,000 of student debt owed to the federal government for households earning less than $250,000 per year and people earning less than $125,000 per year. That will cost the most: from $330 billion to $390 billion, according to the Committee for a Responsible Federal Budget.