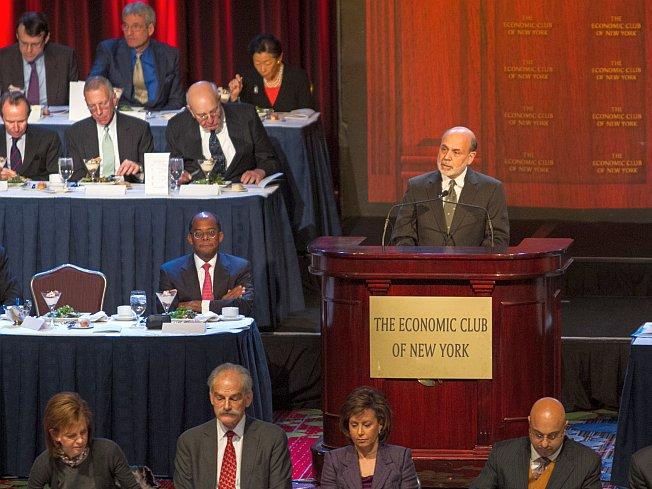

NEW YORK—The Federal Reserve will do everything in its powers to reduce unemployment and spur economic growth. Ben Bernanke confirmed that in a speech given at the Economic Club of New York Nov. 20. Fed power, however, has its limits.

“The ability of the Fed to offset headwinds is not infinite. We have obviously used our easiest tools,” said the Fed chairman, while vowing that the Federal Reserve will continue to support the U.S. economy as much as it can “in the context of price stability.”

Since the financial crisis in 2008, the Federal Reserve has slashed interest rates on its Federal Funds Rate to zero. It also communicated to the market that this “exceptionally low” Federal Funds rate will persist until the middle of 2015. This helps banks and investors reduce uncertainty about interest rates.

The other unconventional tool the Fed used was buying up trillions of dollars of Treasurys and mortgage-backed securities starting in 2008 in order to reduce rates for consumer loans and improve liquidity in some of these markets.

At the moment, the Fed is buying $40 billion of mortgage-backed securities per month. It is the third program of so-called quantitative easing, or QE, that the Fed has undertaken since 2008.

These measures indeed helped to ease liquidity concerns in the banking sector. They were part of the reason—along with strong fiscal stimulus—that prevented the U.S. economy from sliding into a full-blown depression in 2008–2009. After the complete halt in credit transactions in the fall of 2008, credit eased up and consumers and businesses were able to borrow again.

The current QE program is without a time limit and will go on until the unemployment rate decreases meaningfully.

Bernanke Admits Fed Powerless Ahead of Fiscal Cliff

“Congress and the administration will need to protect the economy from the full brunt of the severe fiscal tightening at the beginning of next year that is built into current law—the so-called fiscal cliff,” the Fed chairman said in his speech.

If the two parties cannot strike a deal, beginning in 2013, there will be automatic cuts in spending and increases in taxes worth $667 billion, or 4.3 percent of GDP. Bernanke said that would definitely tilt the economy toward recession as the Fed can only stand by and watch.

“I don’t think the Fed has the tools to offset that,” were the words that sent markets reeling. S&P 500 futures immediately lost eight points after the sentence hit the tapes and trading screens around the world. The S&P managed to recover all of its losses later on to close at 1386, losing only a fraction of a point.

The Epoch Times publishes in 35 countries and in 19 languages. Subscribe to our e-newsletter.