Mortgages are harder to come by in China, a sign, experts say, that bankers are recognizing the risk involved in the real estate market.

According to a recent survey, banks reduced issuing mortgage loans in at least 17 major cities last month.

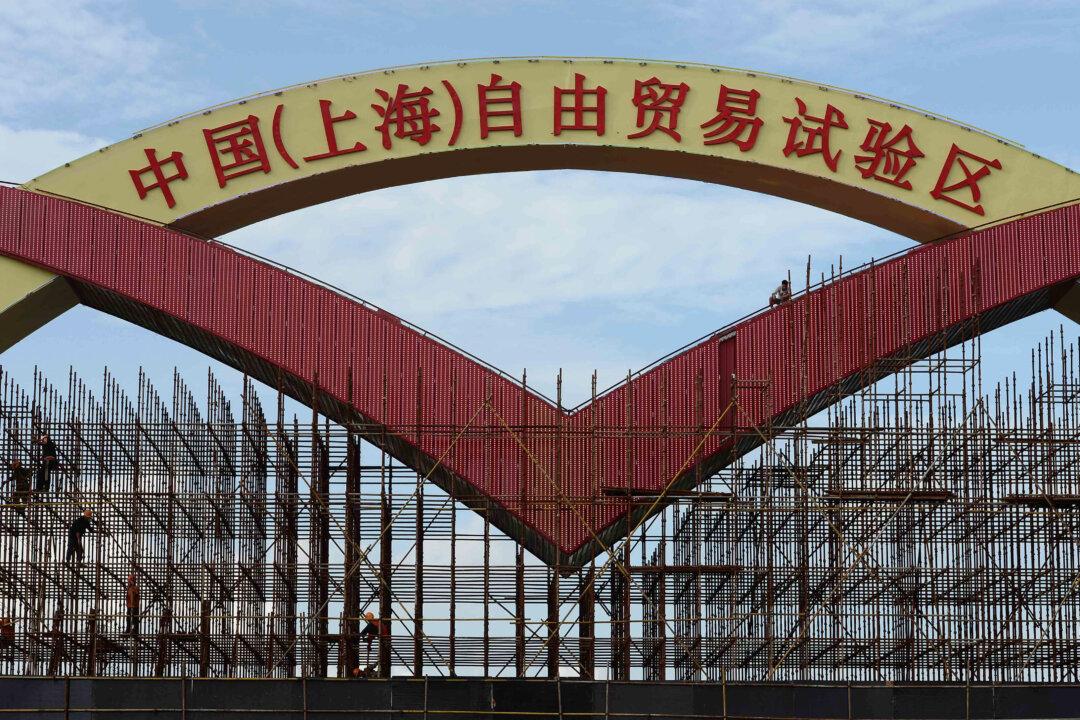

An Epoch Times reporter on the ground confirmed the results of a recent survey: that a “mortgage shortage” is spreading from first-tier cities like Beijing, Tianjin, Shanghai, Guangzhou, and Shenzhen to second- and third-tier cities. In 17 of the 32 key markets, banks are either slowing down mortgage lending or have stopped altogether.

Z-Park Association for Internet Finance and the Rong 360 Research Institute surveyed 500 banks in 32 key cities for the period from Oct. 11 to Nov. 11. Its survey showed that 17 among the 32 key cities have slowed down mortgage lending.

The research department of Beijing Lianjia Real Estate Agent Co., Ltd. released the October report Nov. 19.

Based on the report, it becomes clear banks are using the following strategies to slow down lending. The rate for first time buyer has increased, and the banks’ screening processes for granting loans have become increasingly stricter. In addition, the time it takes to approve the loan has lengthened significantly.

“Almost every reasonable person, including Chinese bankers, thinks there is a bubble in China’s real estate market, and investing in it carries an increasingly high risk,” wrote Jason Ma, a commentator on China’s economy for the New York-based New Tang Dynasty Television, in an email.

Zhang Dawei, the director of the Central Area Real Estate Marketing Department in China, agrees. He said the idea of a real estate bubble is now mainstream thinking and the current risks in the market are huge.

No Money to Lend

In the meantime, prices keep going up—for now.

Compared with last year, prices increased in 69 of 70 major cities according to a Nov. 18 report by the National Bureau of Statistics. Prices increased more than 10 percent in 21 cities.

Similar to the U.S. subprime crisis, however, the market needs continued lending for prices to go higher. This self-reinforcing cycle might be coming to an end as banks reduce lending now.

Jason Ma, however, does not see the tightening in the mortgage market as having a big effect in reducing home prices. “Policies, such as property taxes, will have a greater impact on China’s housing prices than the relative availability of mortgages.”

Guangzhou City announced that the down payment for buying a second home cannot be lower than 70 percent of the value of the house. It is the third city after Shanghai and Shenzhen to carry such a policy. So while the housing market continues to heat up, banks have begun to withdraw.

“The rising prices and the scarcity in mortgages hurt those families who really need the houses more than those who use houses as a form of investment,” said Ma. “The wealthy Chinese have a surprising amount of cash. This development may even benefit those investors because they can buy with cash, and have fewer competitors.”

Chen Guoqiang, deputy head of the China Real Estate Society, believes that some of the reduction in mortgages might be seasonal. Banks generally give out most of their loans in the first half of the year. So at the end of the year, their loan money would be almost exhausted. By November, December, many banks are helpless in giving out mortgages.

A branch manager of China Construction Bank told the Epoch Times that loans were relatively easy at the beginning of the year when the bank has adequate reserves. However, after a central bank induced liquidity squeeze in June, reserves have dwindled toward the end of the year.

Every bank has to meet a certain ratio of loans to deposits and cannot go below the required ratio. According to the branch manager, lending to small and medium enterprises as well as individuals all need to be tightened up. Large corporations such as state-owned enterprises remain the exception.

In addition, Lin Zefu, associate dean of the management school at Central Finance University in Beijing believes banks net interest margins are decreasing, lowering their incentive to lend.

High Risk

Li Yongzhuang, director of the Domestic Economy Research Center at the Central Finance University in Beijing, cites increased risk of changes in regulation. Normally, mortgage loans takes 20 years to pay back. In such a long time range, it is possible that government policies could change, pushing down the price.

If the real estate price goes down and debtors refuse payment or default, banks could not absorb such a loss. In turn, banks lower their risk exposure.

Even real estate developers are looking for other opportunities.

Big companies, such as Vanke and SOHO are planning to enter overseas markets and Vanke started to diversify its business by exploring different industries and locations.

It is precisely the companies that reaped the most profit from the boom times that are looking for other opportunities.

Some wealthy investors will no doubt choose to continue taking their chances on a real estate market that has so far rewarded them.

“With more ordinary Chinese pushed out of the housing market, it now becomes solely a game for the wealthy,” said Ma.

Translation by Quincy Yu. Written in English by Valentin Schmid.

Read the original Chinese article.