Bank of Canada governor Stephen Poloz strongly endorsed inflation targeting as a modus operandi for central banks, but feels that monetary policy needs to do a better job incorporating financial stability risks given globally interconnected financial markets and economies.

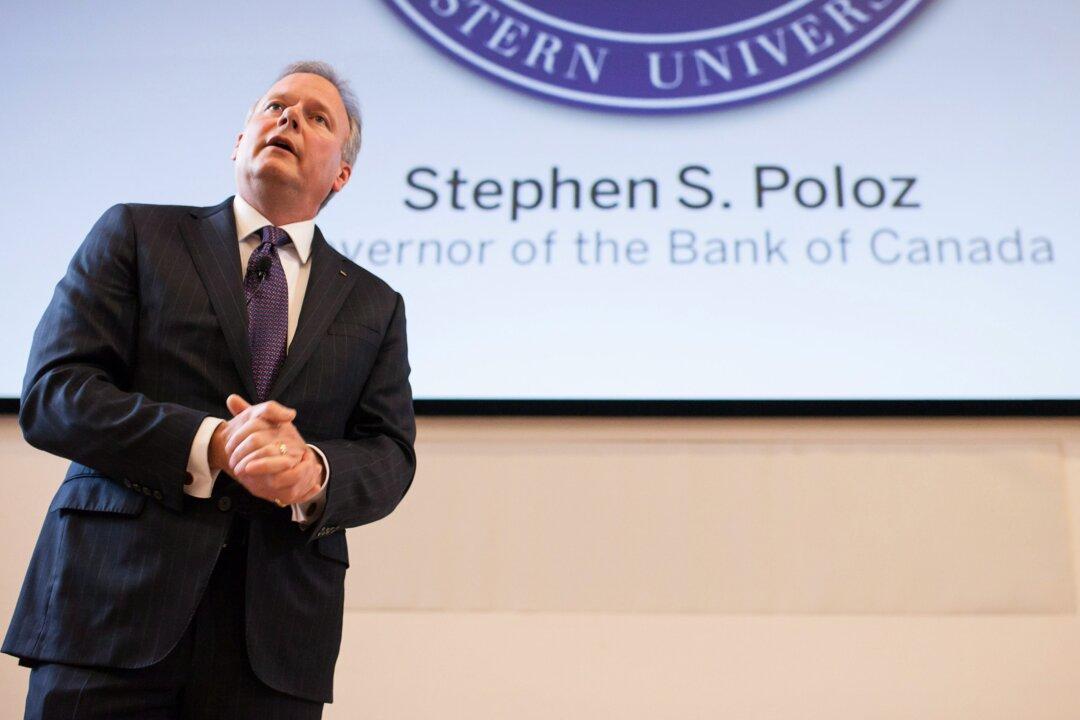

Poloz spoke at Western University’s Ivey Business School in London, Ont., on Tuesday, Feb. 24. The title of his speech was “Lessons New and Old: Reinventing Central Banking.”

His statement that the Jan. 21 rate cut “buys us some time to see how the economy actually responds,” was a key phrase that financial markets interpreted to mean that another rate cut on March 4 was now less likely.

The Canadian dollar which was hovering around $0.795 U.S. prior to the speech appreciated to slightly north of $0.80 U.S. after the release of the speech and the TSX fell by roughly 75 points.

In his Q&A session, Poloz said that the central bank’s assumption for the price of oil at the time of the last interest rate decision, which drives many of their projections, seemed to be holding up reasonably well and that they had taken out the “appropriate amount of insurance [0.25 percent rate cut], given what we knew.”

Toward the end of his speech, the governor touched how this action supports both inflation targeting and financial stability.

The oil price shock has become a major headwind to reaching economic potential and the 2 percent inflation target—the “traditional” things central banks focus on. Financial stability used to be seen as the responsibility of regulators, but central banks are increasingly factoring it in when conducting monetary policy.