A growing number of highly qualified, low-income students are discouraged from going to college today. According to a study by the New America Foundation (NAF), many of the financial programs for college loans and grants have complicated requirements and explicit restrictions on the amount of savings families can have. These rules are acting as disincentives for low-income students and their families to save for both short-term and long-term goals.

The authors of the NAF report, Rachel Black and Mark Huelsman, write in “Overcoming Obstacles to College Attendance and Degree Completion” that the rules and restrictions of public assistance programs can be confusing. “Asset limits create an impression that low-income families are not eligible even if they are.”

Economists Jason Furman and Jason Bordoff compare the missed opportunities to a customer finding out about a rebate after they buy a car. “Customers who were willing to buy at the pre-rebate price would be pleasantly surprised ... and customers scared off by the sticker price would never even learn about the rebate.”

Moreover, the report notes, “Over the past couple of decades, tax subsidies have increasingly become, functionally, part of a student’s financial aid package. However, due to their structure and administration, they have limited benefit to the student with the greatest need.”

Low-income families with low to no tax liability don’t benefit from tax subsidies as the higher-income families do.

529s

The 529 is the primary college savings instrument and is offered in every state. There are 10 million 529 accounts open nationwide, according to the report. The plan is more welcoming to low-income families, often costing only $25 to open an account compared to $1,000 to $3,000 required to open a mutual account.

According to the report, some low-income families can accumulate up to $2,000 in three years, with only $900 being their own money.

However, nearly 70 percent of households with children under 18, and salaries less than $35,000, were “not familiar” with the 529, states the report.

“Families with low incomes, however, have no need to pursue ways to limit their tax liability and, therefore, would be less familiar with options to do so,” explains the report.

Many low-income families are not using the 529, but traditional means such as checking, saving, or other similar accounts. These accounts can limit assets, some as low as $1,000. The saving thresholds were often put into place decades ago, and are too low for present families, the report states.

FAFSA

Applying for financial aid itself can be discouraging. Parents are required to fill out the Free Application for Federal Student Aid (FAFSA), with 150 “highly-detailed” financial questions.

Jenna Jones, a junior at Delaware State University, says answering FAFSA questions is “not difficult, but getting the data is a little hard.”

According to the report, many FAFSA questions are irrelevant to determine a student’s award.

The White House says that six asset questions could be replaced by one. Asking if the family owns more than $250,000 worth of assets (excluding home and retirement accounts) can provide enough information to replace six current asset questions.

In 2009, more than 30 percent of full-time community college students whose family makes below $50,000 did not complete the FAFSA, although many were eligible for financial aid, according to the White House.

Necessity of Saving

While tuition has grown over the years, the amount of financial aid given has not grown in proportion. Nearly half of the states have decreased their need-based aid budget, according to the report.

Even after financial aid is given, families making less than $30,000 must use three-quarters of their annual income to cover the remaining costs of a college education. Families earning $30,000–$54,000 would have to spend over one-third of their income.

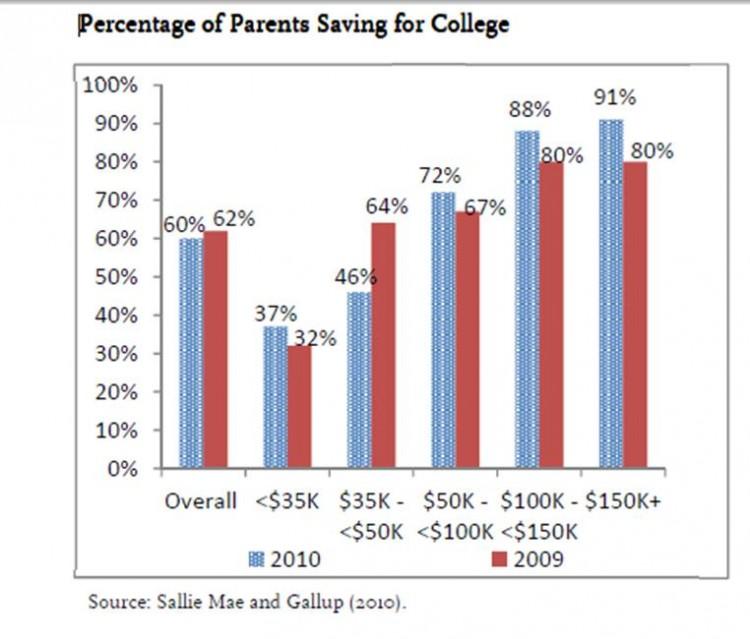

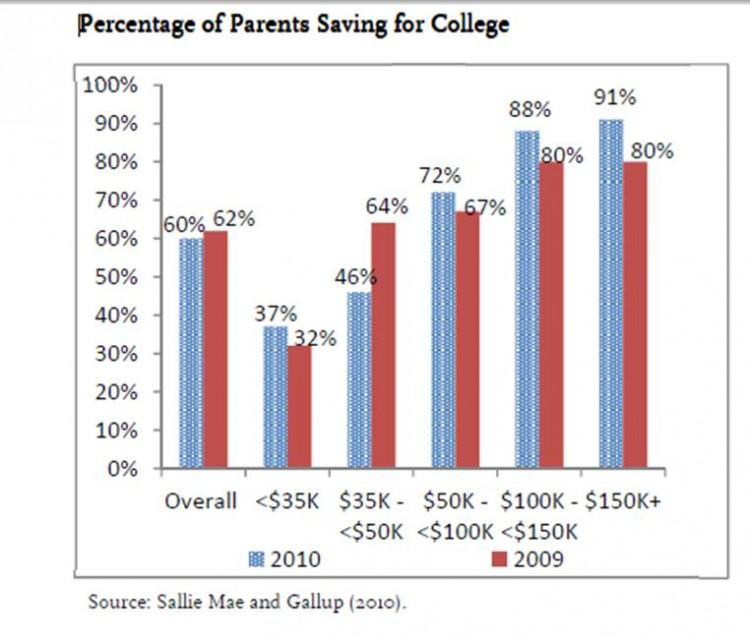

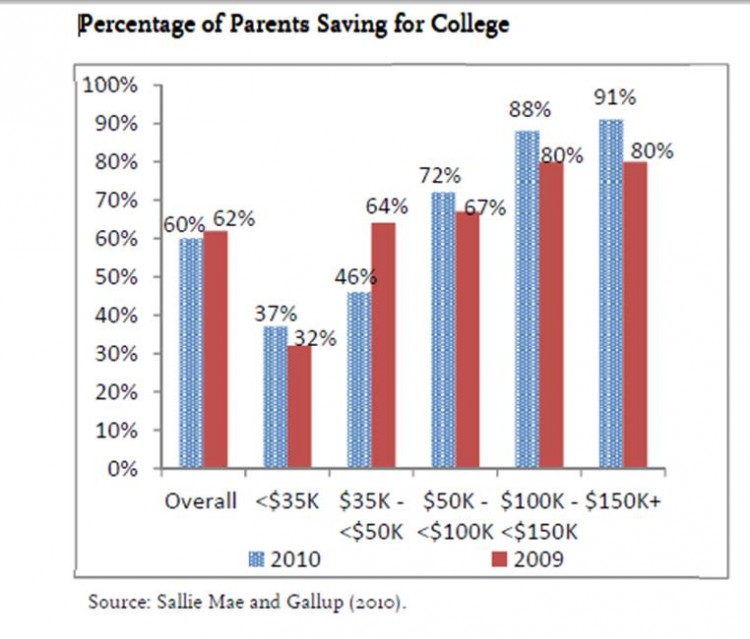

The report says that slightly over a third of parents earning below $35,000 are saving for their child’s college education; their average savings is less than $14,000. While that amount won’t go very far toward paying for college expenses, low-income families that value a college education are trying their best. “However, they are penalized by public assistance rules that restrict the amount of savings they can have to receive benefits,” says the report.