Apple Unveils Long-Awaited iPhone 5

Apple Inc. unveiled the long-awaited iPhone 5 at another sensational event in San Francisco Wednesday.

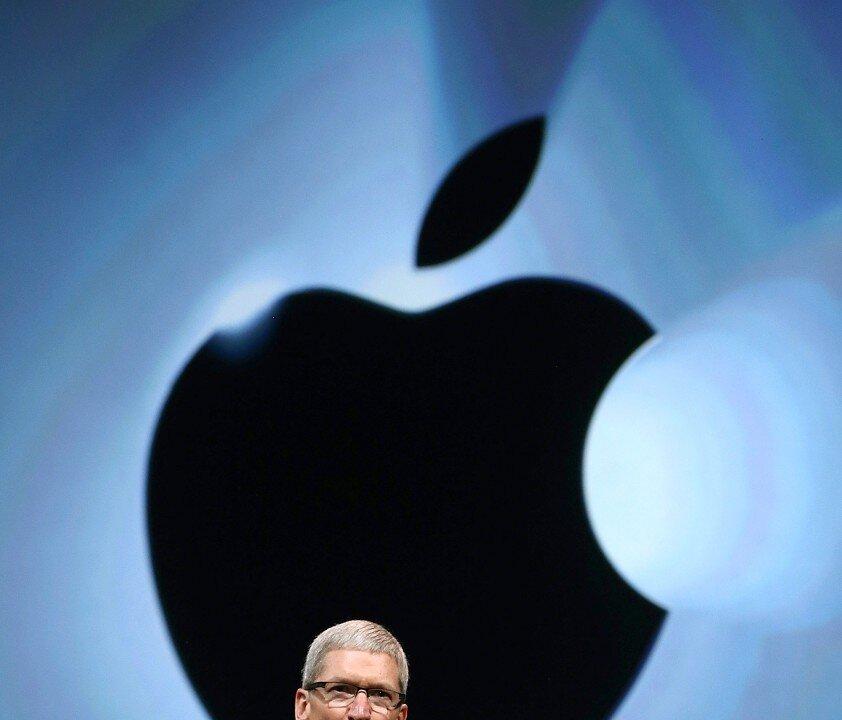

Apple CEO Tim Cook speaks during an Apple special event at the Yerba Buena Center for the Arts in San Francisco, Sept 12. Apple announced the iPhone 5, the latest version of the popular smartphone. Justin Sullivan/Getty Images

|Updated:

Valentin Schmid is a former business editor for the Epoch Times. His areas of expertise include global macroeconomic trends and financial markets, China, and Bitcoin. Before joining the paper in 2012, he worked as a portfolio manager for BNP Paribas in Amsterdam, London, Paris, and Hong Kong.

Author’s Selected Articles