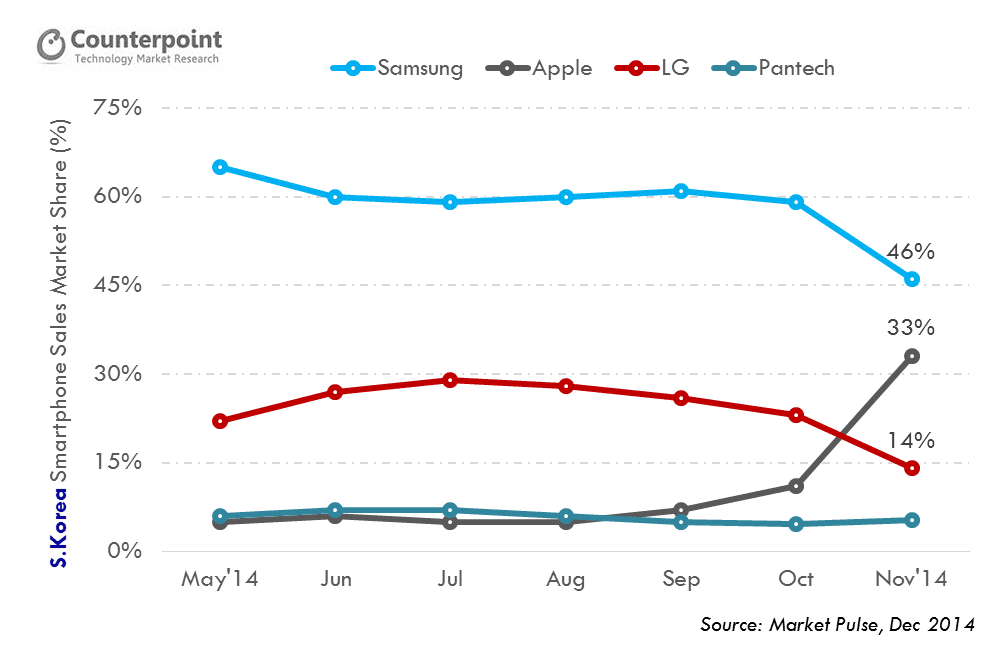

According to new research by Asia-based Counterpoint Technology Market Research, Apple sold more than 20 million iPhone units in November of 2014, shortly after it rolled out the iPhone 6 and 6 Plus with bigger screens. It now has over 51 percent market share in Japan and one-third in Samsung’s home market of Korea.

“No foreign brand has gone beyond the 20 percent market share mark in the history of Korea’s smartphone industry. It has always been dominated by the global smartphone leader, Samsung. But iPhone 6 and 6 Plus have made a difference here, denting the competition’s phablet sales,” says Counterpoint’s research director Tom Kang.

For ACI research director Ed Zabitsky, Apple’s move to satisfy the demand for larger displays was a no-brainer.