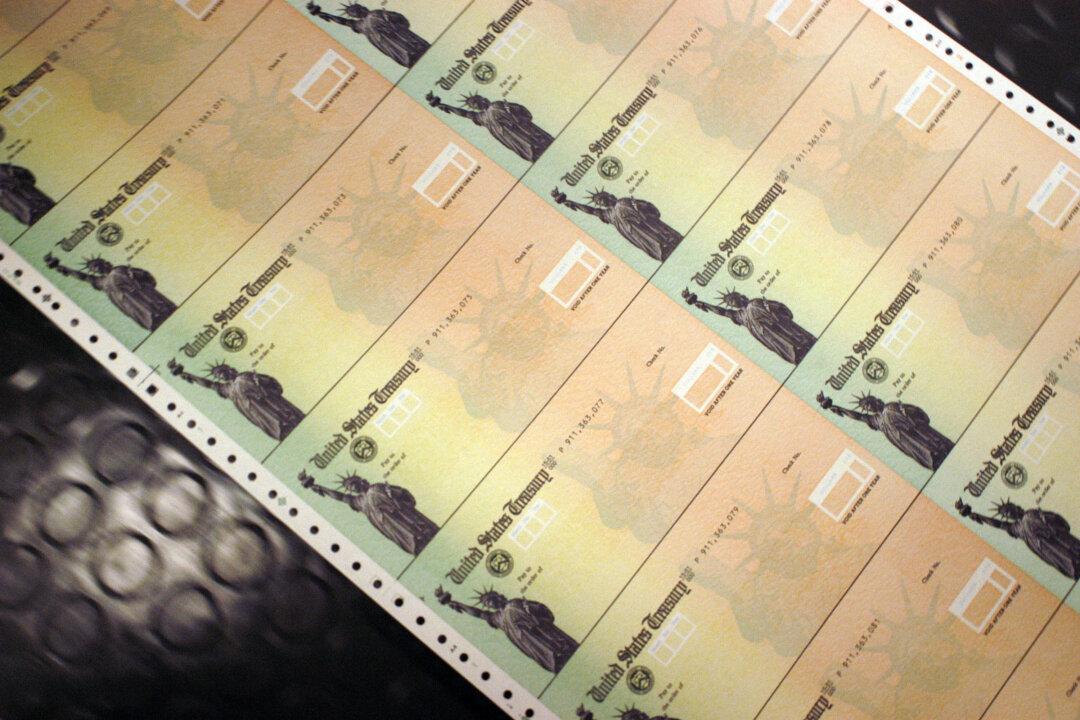

Millions of Americans could face a “refund shock” when they file their taxes next year because a number of pandemic-related programs are set to expire or have expired, said an analyst.

Data from the Internal Revenue Service (IRS) shows that the average refund taxpayers got back for their 2021 taxes was about $3,200, or some around 14 percent higher than the previous year. The next refunds will average about $2,700, said Mark Steber, chief tax information officer at Jackson Hewitt.