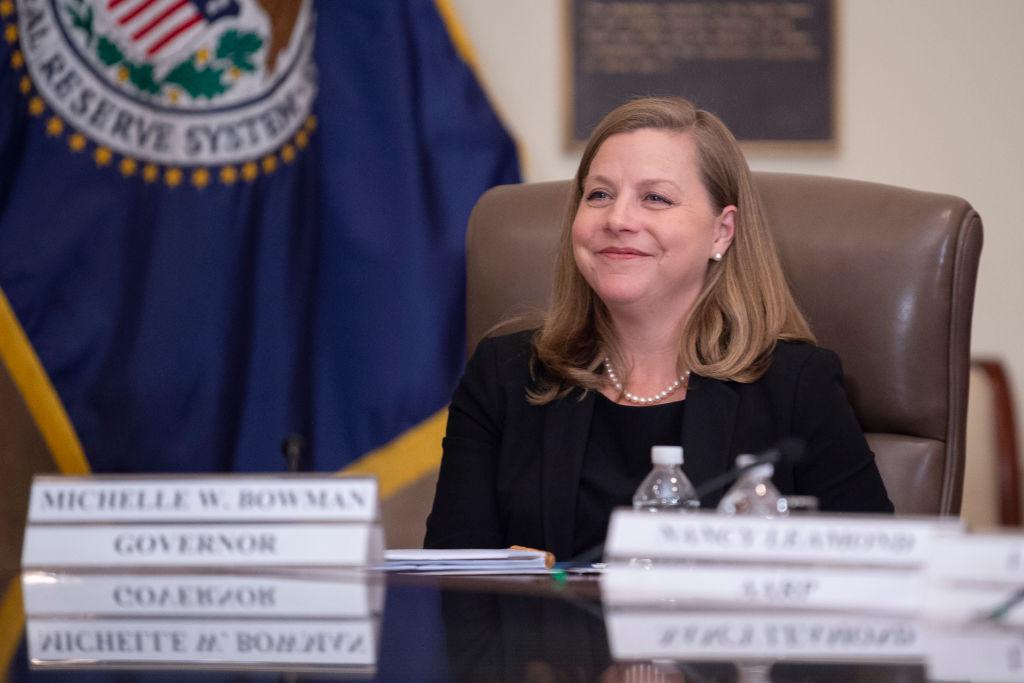

Interest rates will likely need to be higher to eliminate inflation from the U.S. economy, says Federal Reserve Gov. Michelle Bowman.

Speaking at a business conference in Alberta, Canada, on Oct. 2, the central bank official argued that policymakers would need to pull the trigger on additional rate hikes to tackle price pressures, particularly as the recent spike in energy prices threatens the institution’s gains over the past year.