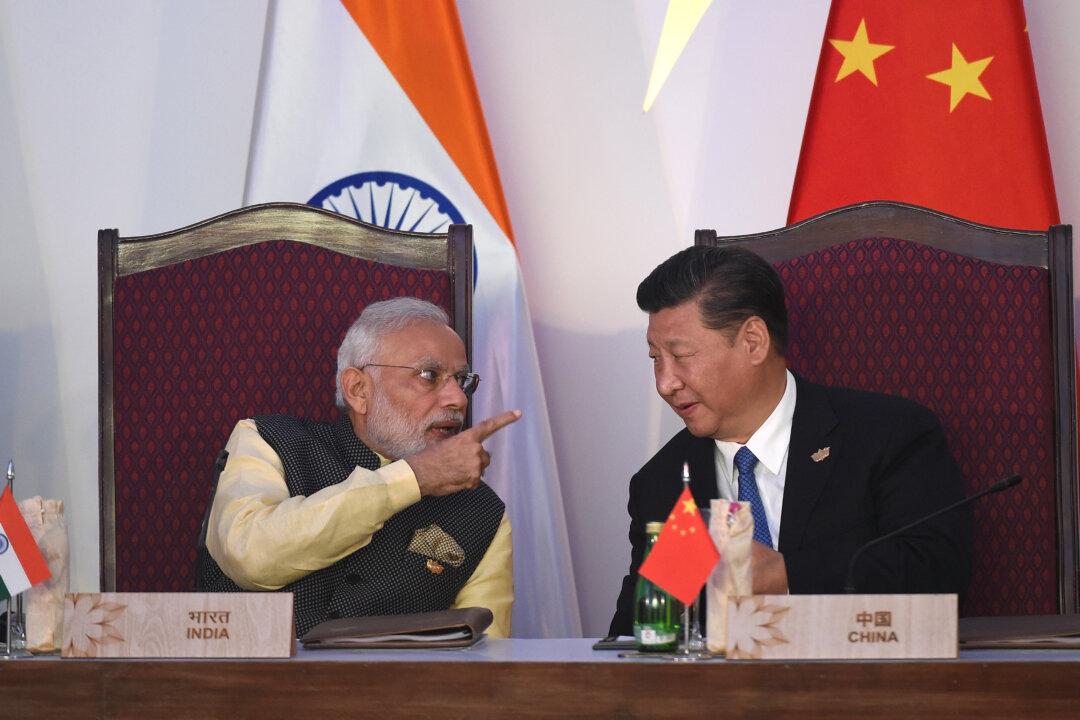

A top U.S.-based group that advocates for strong business relations with India recently revealed that about 200 U.S. companies have contacted them about the possibility of setting up an alternative manufacturing base in India to replace their current assembly lines in China.

In an April 27 interview with Press Trust of India, India’s largest news agency, Mukesh Aghi, president and CEO of the Washington-based U.S.-India Strategic Partnership Forum, said that in the past several months, he has received an increased number of inquiries from roughly 200 U.S. companies.