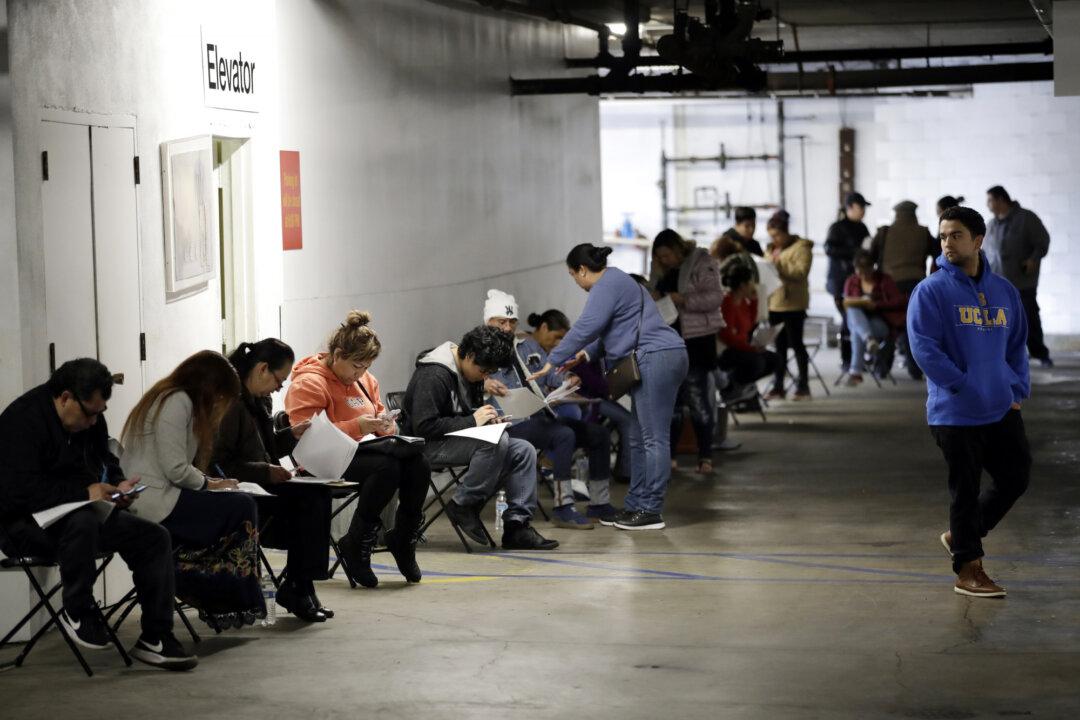

The number of Americans filing new claims for unemployment benefits last week ticked down by 33,000 from the previous week to 860,000, as the labor market continues its grueling recovery from the COVID-19 recession.

The Labor Department also noted in its Sept. 17 release (pdf) that the previous week’s initial claims for state unemployment benefits were revised upward from 884,000 to 893,000.