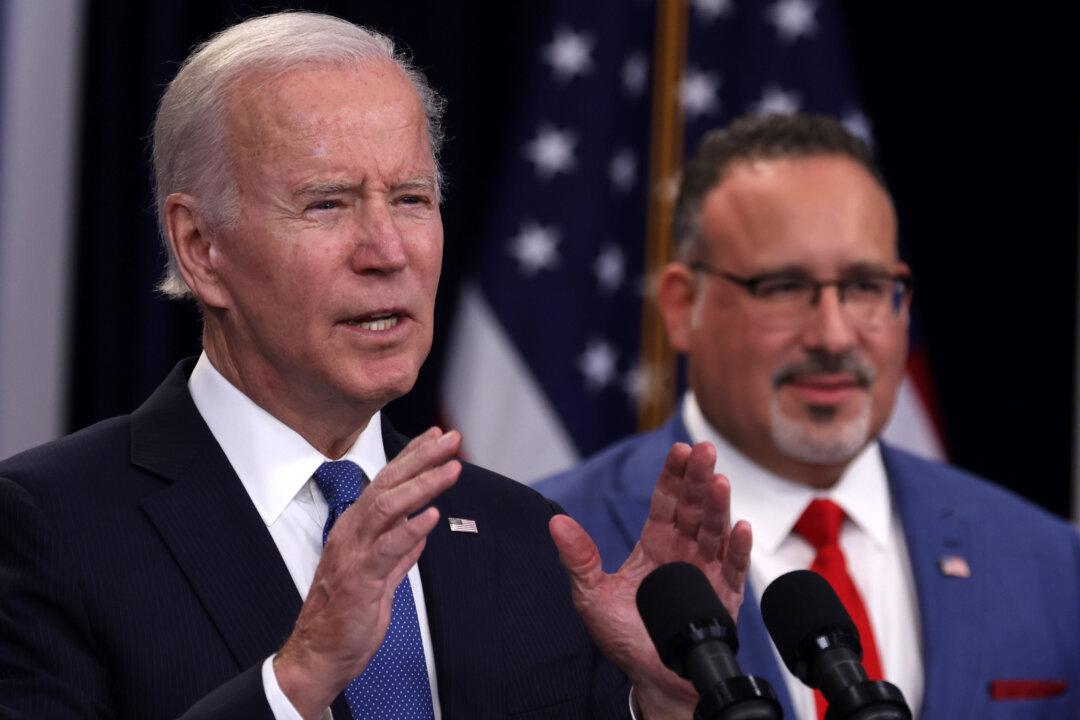

As the Biden administration’s plan to erase more than $400 billion in federal student loan debt failed at the U.S. Supreme Court, both Democrats and Republicans are saying they have an answer to help with the looming student loan default crisis.

To fulfill his campaign promise, President Joe Biden has pledged that he'll still push through a blanket student debt cancellation but using a different legal authority to do so.