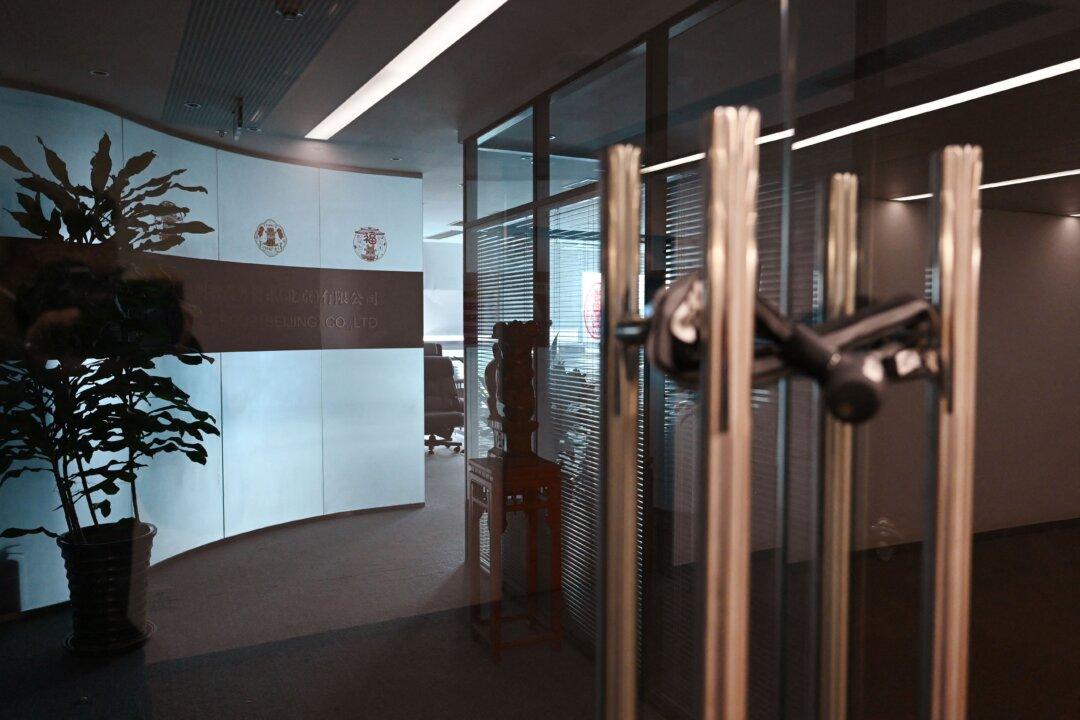

As China’s economy continues to decline, Chinese authorities have adopted a heavy-handed approach to “regulating” foreign companies in recent weeks. The tactics have chilled foreign investment in China and triggered a massive capital outflow.

Meanwhile, China’s premier effusively welcomed global executives at the China Development Forum in late March. The contradictory moves—simultaneously welcoming and distrustful—highlighted the ambivalence of the Chinese Communist Party (CCP) and its “struggle philosophy,” say experts.