Commentary

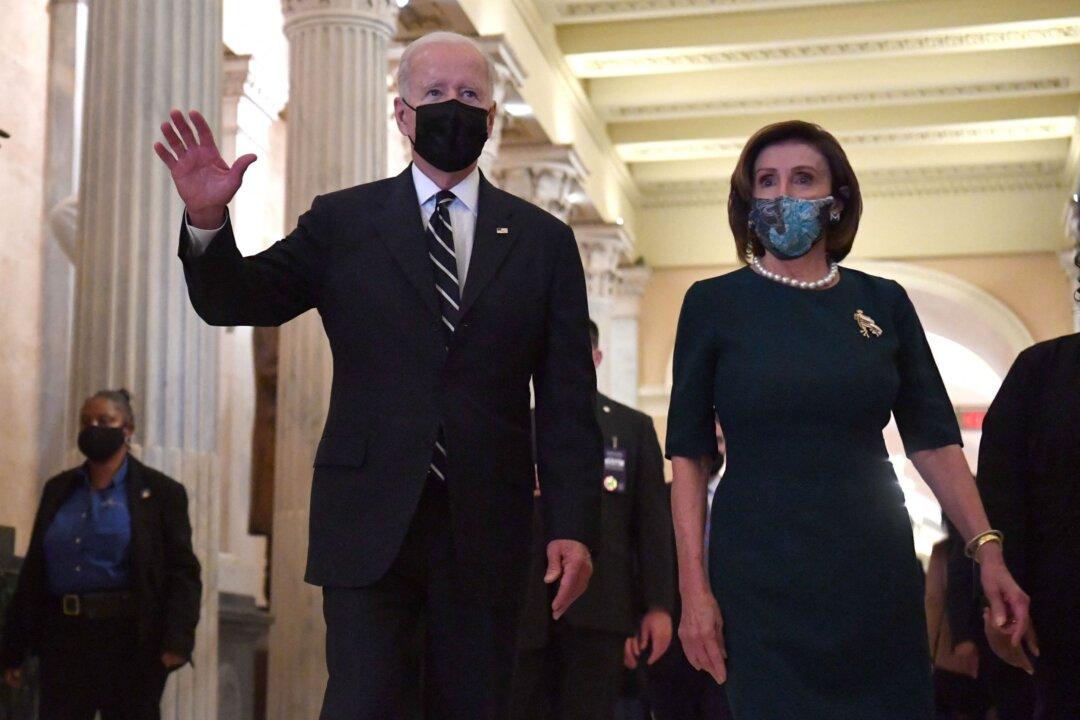

President Joe Biden repeatedly said he would raise taxes only on the rich to pay for his Build Back Better plan, but now he’s backing a tax break for millionaires and billionaires, contradicting his promises.

President Joe Biden repeatedly said he would raise taxes only on the rich to pay for his Build Back Better plan, but now he’s backing a tax break for millionaires and billionaires, contradicting his promises.