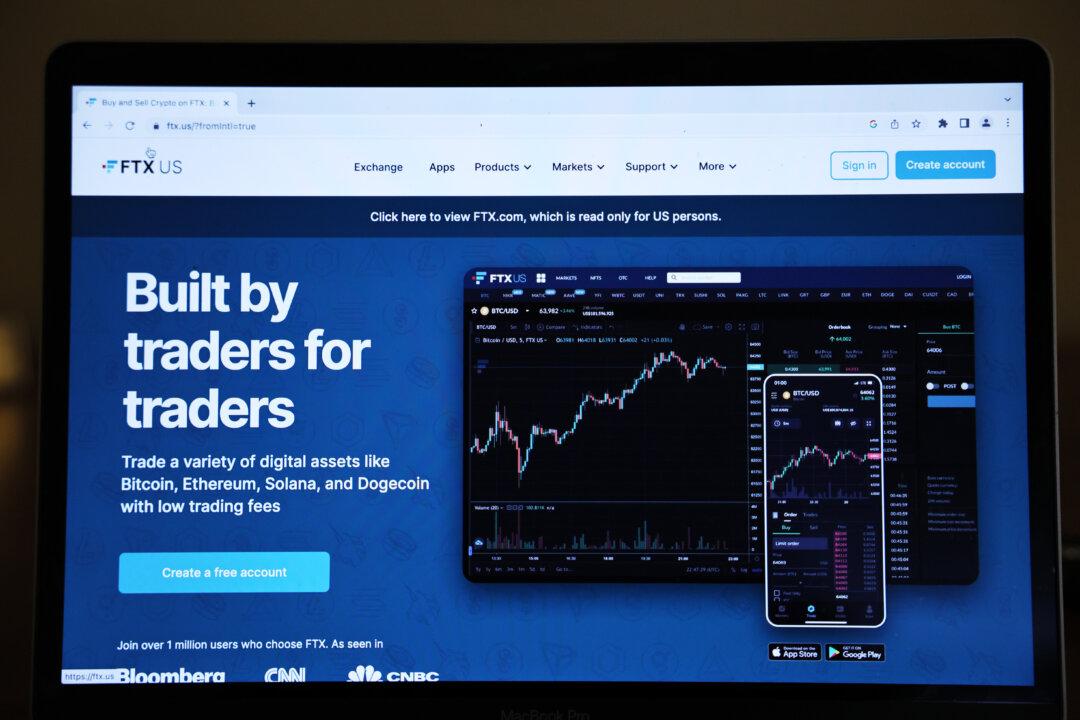

Thousands of Australian crypto investors have found themselves in a precarious situation and now face the risk of losing their entire investments following the collapse of the popular crypto exchange FTX.

According to the Australian Financial Review, close to 30,000 Australian investors are now looking to recover part of their losses after the crypto trading platform declared bankruptcy.